|

Fixed Assets,

FF&E Straight

Line

Depreciation

Software

View

Price page

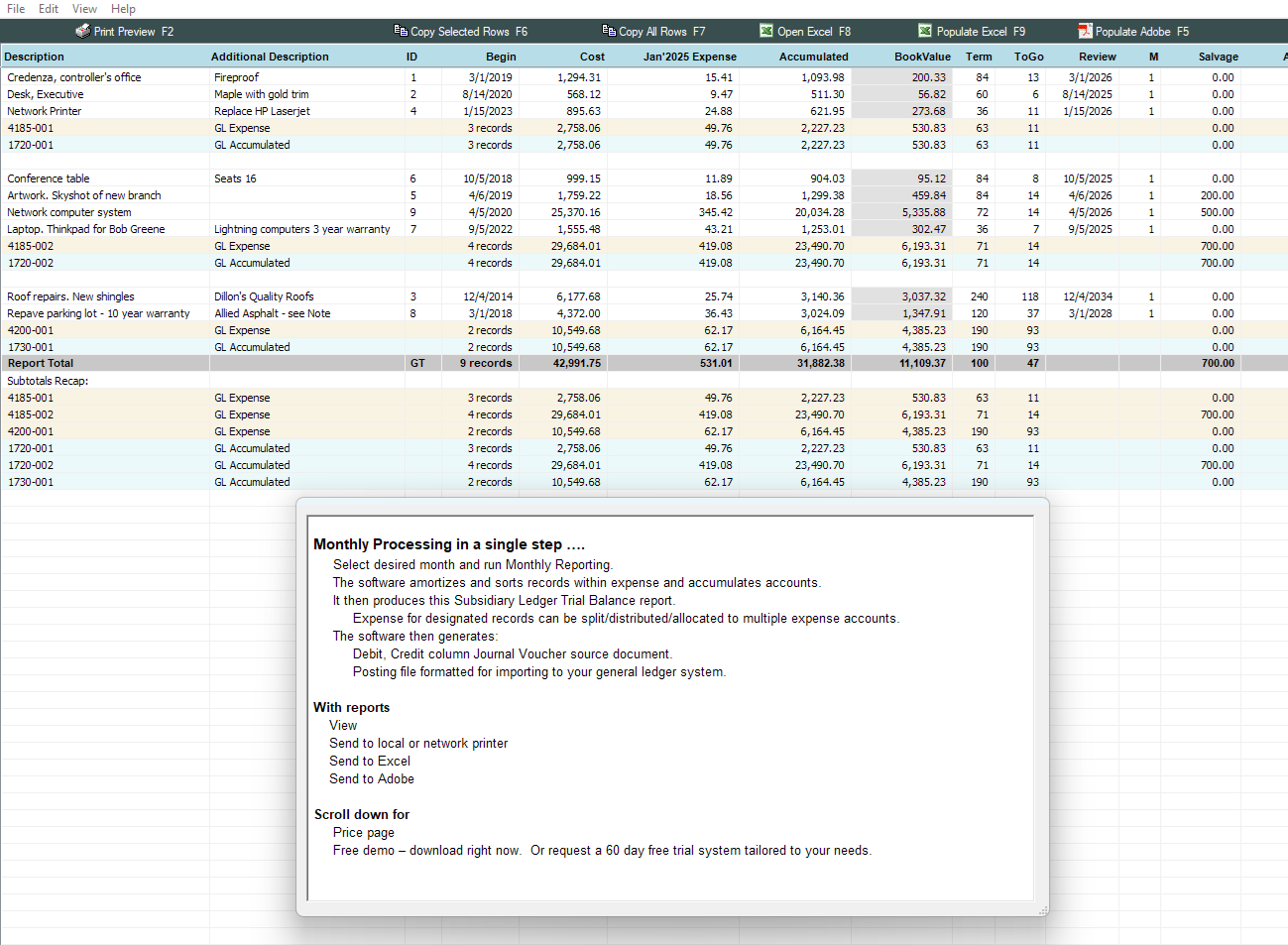

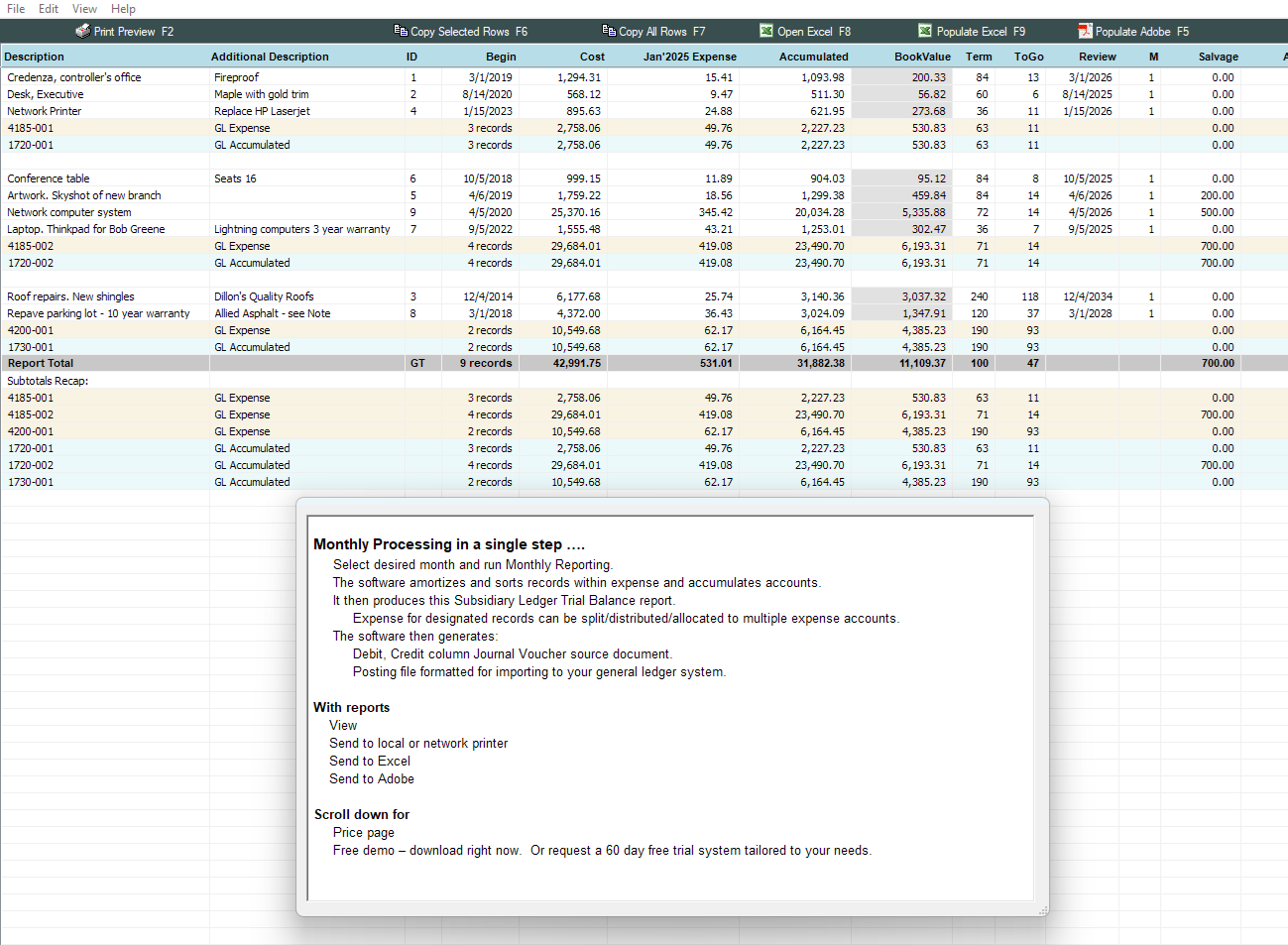

Generate a

complete set of

monthly reports

in minutes ....

1) Depreciation expense for all records at the same

time

2) Subsidiary ledger report with general ledger

subtotals

3) Split, allocate expense to multiple general ledger

accounts

4 Journal Voucher debit, credit column posting source

document

5) Posting file to update your general ledger using

Excel or disk

file

Fixed Assets

FF&E

Furniture

Fixtures

Equipment

Leasehold

improvements |

Vehicles, accessories

Buildings,

structures

Computers,

networks

Security

systems

Tools,

machinery

Upgrade

costs |

Landscaping

Prepaid

rentals

Parking

area, facilities

Durable

office goods

Below

threshold items

Other

tangible

property |

|

Meets

requirements for

GAAP

Record

keeping,

straight line

depreciation

schedules,

subsidiary

ledger, journal

voucher, annual

recap and more.

AICPA

Many of our

clients are CPA

firms importing

client records

from Excel to

prepare monthly

financial

accounting

reports.

SOX - Sarbanes

Oxley

History

archiving

electronically

preserves all

reports for

recall at any

future date.

Available as

BASIC SYSTEM

Monthly

depreciation and reports

which satisfy

the need of most

clients.

ADDITIONAL MODULES

For clients requiring one or more

specific

functions such

as allocating

depreciation

expense to multiple

branches.

Existing records

Import and convert records in Excel.

Preserve current Book Values.

General Ledger

Posting Files for ANY

general ledger

system using ANY

chart of

accounts

Posting

transactions can consist

of:

1) Expense debits and Fixed Assets offset

credits are subtotal

amounts for each general

ledger account.

2) Expense debits are for EACH Fixed Assets

record. Offset

credits are subtotal

amounts for each general

ledger account.

3) Expense debits are for EACH Fixed Assets

record. Offset

credit for EACH

record.

Supports ANY

general ledger import format:

Multiple columns.

Dots. Dashes.

Split values.

Leading

zeroes. Trailing zeroes.

Disk file.

Worksheet. D/C.

Signed. (Credits).

Fixed length.

Excel. Tab

delimited.

Split general ledger account numbers into

multiple

columns.

Branches. Departments. Divisions.

Types.

Codes.

Other

user

defined

requirements.

Expense distribution, splits, allocation to

multiple

general

ledger

accounts.

We provide or create

ANY format suitable for

suitable

for

updating ANY

general ledger system.

Allocate (distribute) monthly expense

• Allocate

one or more selected records

• Distribute depreciation expense for one or more records to multiple branch, cost

center accounts

• Use one or multiple allocation

methods

|

Basic

System

consists

of these

features

Records:

Straight

line

depreciation

and

monthly

reporting.

Add

records

in any

order.

Sort

list by

any

column

value

Book

values.

Preserve current book values or

Software can calculate records current from original

begin

dates

New

record:

Capture

prior

months

expense

if set

up late

Defer

depreciating

to a

future

"in

service"

future

month

Adjustment

screen

with

single

step

entry

to:

Increase

cost,

such as

additional

charges

during

term

Decrease

cost,

such as

partial

refund

during

term

Change

remaining

term

Write-off

this

month

Edit

other values

at any

time.

Delete

old

records:

Sort by

book

value

Delete

0.00

book

values

in a

single

step

Terms of

1 to 999

months

at the

record

level:

Monthly

or

Date-to-date

with

partial

days in

first

and last

months

Calculation

methods

supported

at the

record

level:

Straight

line 30

day

financial

months

Half

month

convention

Date to

date

actual

calendar

days,

including

half

month

convention

Accelerated

sum of

the

years

digits

(rule of

78's for

any

term)

Immediate

depreciation

schedule

while

adding

or

editing

a

record.

Reports:

"2

click"

monthly

reporting.

Generate

a report

stream

with two

clicks

of the

mouse

No

monthly

close

out

required.

General

ledger

subsidiary

ledger

trial

balance:

Records

sorted

and

grouped

by

general

ledger

accounts

Separate

totals

for

salvage

value

Debit

and

credit

Journal

Voucher

postings

General

ledger

subtotal

level or

Individual

posting

for each

record

Supports

any

chart of

accounts:

General

ledger

base

accounts,

branch,

department

and cost

centers

....

Calculations

for

future

time

periods

New

records

report

Additions

for any

time

period,

such as

year to

date,

grouped

by

general

ledger

account

Review

date

Automatic

Review/Maturity

date

calculation

with

tickler

report

MySubtotals

report

Group

and

subtotal

records

by any

field

value

Filters:

Create

selective

reports

using

field

and date

filters

|

Modular

pricing.

Add one

or more

of these

available

features

....

Import

records

from

Excel

and

other

spreadsheets

Automatically

add

records

from

another

source

to the

software.

Import

dozens,

hundreds

or

thousands

of

records.

The

software

verifies

data

values

are of a

correct

format

and

lists

any data

errors

(an

invalid

date,

for

example).

The

software

automatically

calculates

a

maturity/review/tickler

file

reporting

date.

Current

accumulated

and book

value

for

existing

records

can be

preserved

or

calculated

by the

system.

Our

clients

use the

import

feature

in a

variety

of ways.

Some

maintain

all

records

in a

spreadsheet

and

always

import

their

entire

file for

accounting

reports.

Many

converted

all

their

spreadsheet

records

and now

use the

Editing

screen

to enter

new and

edit

records.

Some

converted

and now

add

(append)

new

records

to the

software,

such as

on a

monthly

basis.

New

records

come to

them in

a

file(s):

Created

at

branch

sites.

From

their

Accounts

Payable

(A/P)

department.

Upload

posting

file

with

journal

entries

to

update

the

general

ledger

Creation

of a

General

ledger

upload

posting

file.

File

output

Disk

file

plus

Output

display

with

ability

to copy

posting

file

columns

and

paste to

Excel

Posting

transactions

can

consist

of

Individual

records

or

Subtotals

at the

general

ledger

account

number

summary

level

The

system

comes

with a

standard

4 column

upload

format

in both

a disk

file and

for

exporting

to

Excel.

If a

format

is not

already

supported,

we will

create a

format

to

update

ANY

general

ledger

system.

At no

charge.

Additional

Reporting

Type,

Vendor,

Location

and Link

fields

for user

defined

values

MyReports:

Create

and

retain

user

defined

sort and

subtotal

values

Description

files:

General

ledger

account

names,

Type

codes,

Location

codes,

Vendor

code

names

Export:

Copy

reports,

paste to

Excel

and

other

spreadsheets

Format

and

automatically

populate

Excel

with

reports

Format

and

automatically

populate

Adobe

.pdf

file

Notes:

Maintain

and

report

individual

record

notes

Graphs

Graph

field

values

View

graph.

Print.

Copy

data,

paste to

Excel

and

insert

graph.

History

Archive

-

Retrieve

any

report

from any

prior

month

Monthly

depreciation

and

field

change

activity

for each

record

General

ledger

account

posting

History

Audit

Reports:

Changes

and

Postings

Trial

Balance

and

other

reports

created

from a

History

month

file

Posting

History

Report -

[R]

Reconciliation

Columns

Notes

History

View and

report

notes

for

records

as they

existed

as of

the

History/archived

month

Edit

records

using

Excel

Records

are

normally

edited

using

the

software's

setup/edit

screen,

either

one

record

at a

time or

in

sequential

order.

The

editing

screen:

Performs

data

value

testing

Displays

an

immediate

depreciation

schedule.

But

there

may be

times

when

you'd

prefer

to use

Excel.

This 3

step

procedure

allows

you to:

1)

Copy the

master

file to

a

spreadsheet,

such as

Excel.

2)

Edit

records

using

all of

the

spreadsheet

functions.

Edit

records

Add

records

Delete

records

Fill

down

Sort

Other

Excel

capabilities

3)

Copy

records

from the

spreadsheet

and

paste

back

to/as

the

revised

master

file.

The

software

verifies

all data

values

and

relationships,

such as

dates,

are

valid

and

compatible.

Allocate

depreciation

expense

Distribute

one or

more

general

ledger

posting

amounts

to

multiple

branch,

cost,

revenue

and

other

centers

using

one or

more

Allocation

Methods

maintained

in the

software.

You

assign

each

Method a

name

that is

meaningful

to you,

perhaps

"SQ" to

mean the

Allocation

Method

is based

on the

amount

of

square

feet

occupied

by a

department.

Or "EMP"

to

allocate

using

the

number

of

employees

in each

branch.

Each

Method

contains

your

chart of

account

branch

numbers

(or

cost/revenue

center

numbers

or ....)

along

with the

number

of units

each

contains,

such as

square

feet,

employee

count

and even

your own

assigned

percentage.

Any type

of

numerical

values.

To

allocate

a

record,

merely

replace

the

branch

portion

of a

general

ledger

account

number

with the

Method

name.

The

system

will

calculate

the

percentage

being

allocated

to each

branch

based on

number

of units

and

create

multiple

posting

records,

each for

smaller

amounts

that add

up to

the

original.

User

defined

Alternative

Recognition

Methods

Consumption,

Prepaid

Services,

Inventory

Reduction,

Subscriptions

plus

these

additional

recognition

frequencies:

•

Bi-monthly

•

Quarterly

•

Tri-annual

•

Semi-annual

•

Annual

•

Irregular

frequencies

(e.g.

take 20%

in

months 1

and 2,

then

nothing

for 6

months,

then 40%

and 20%)

•

Pre-determined

amounts

(e.g.

take

$10,000

in month

1, then

$5,000

and then

$2,000

for the

rest of

the

year)

The

system

can

recognize

Cost

based

upon a

count of

Total

Units

reduced

by

Monthly

units

which

are used

or

consumed

in a

given

month.

Total

Units

might

represent:

●

Percent,

where

Total

Units =

100

Monthly

Units

are the

percent

of Cost

to

recognize

in each

month.

●

Prepaid

service,

where

Total

Units

might =

Hours

(such as

650

prepaid

professional

services)

Monthly

Units

are the

number

of hours

utilized

or

consumed.

When the

record

is first

entered

to the

system,

"hours

utilized"

are

likely

to be

unknown.

Simply

enter

zero for

Month1

Units.

As

"hours

utilized"

become

known,

enter

the

hours

into the

appropriate

Monthly

Units

category.

●

Inventory,

where

Total

Units =

Inventory

Count

(such as

2,950

widgets)

Monthly

Units

are the

count of

inventory

items

removed.

Inventory

can

refer to

any

physical

count,

including

office

supplies,

such as

prepaid

ink

cartridges

and

other

expensive

items

retaining

a value.

● Dollar

amounts,

where

Total

Units

might =

Cost

Monthly

Units

are

specific

dollar

amounts

to

recognize

each

month.

●

Virtually

any

other

type of

numerical

Units.

Monthly

Units -

Positive,

negative

or zero

•

Positive,

to

reduce

Total

Units

remaining.

•

Negative,

to

increase

Total

Units

remaining

(typically

to

correct

an error

or

return).

When

Monthly

Units

are

negative:

Remaining

Units

will be

increased.

Depreciation

for the

month

will be

negative.

• 0,

meaning

zero

units

were

used in

a month.

No

Depreciation

will be

recognized.

Zero

Monthly

Units

also

allow

Depreciation

to be

recognized

other

than

monthly.

Use zero

Monthly

Units to

"skip"

months,

thus

accommodating

Quarterly,

Bi-Monthly

and

other

Depreciation

frequencies.

|

|

Price page and free demo .... |

Price Page

with free demo

Click to open and view

Price page

which has a link to download a free demo zip file at

any time.

Free demo

includes:

• A live version of the software

• Sample records

• Ability to run all reports

Questions about your needs?

Call 1-800-245-8444 or

email

Support@fdssi.com

|

Administrative reports

New records: List new records for the month,

Y-T-D and other time periods

Maturity/Review

date: A tickler file showing records that are

nearing the end of their term

Vendors: If desired, add vendor name or

code and get a list of total

cost for each vendor

Type: If desired, assign a type code to

group records for desired

purpose other than expense

account

Link: If desired, tie records together by

a common purpose, such as all IT

and other department costs

Alpha: Alphabetical listing of

records in

description

order

Filters: Alpha and monetary values, dates

and date ranges

Select all records for a report

or

Use one or more filters to only

included specific records, such

as cost > $1,000.00

Reconciliation: Beginning balances, new

records, amortization, ending

balances for month, year

MySubtotals: Filter and obtain records

and subtotals sorted by

selected values on the fly

MyReports: Create and retain reports,

filters and sorted subtotals you

need for repetitive runs

Records only or Subtotals only: Run

reports with or without

individual records for "Totals

only" (shorter report)

Amortization periods: Expense plus ending

book values for 1 month, range

of months, entire year

Columns: Expense for multiple months,

entire year, displayed in

multiple monthly columns, past

or future

With reports:

View

on screen

Send to printer

Export to Excel

A great way to respond to a

request from your boss

Or export all or filtered

records and do whatever

reporting you want in Excel

Export to Adobe

|

Price ....

Click to open and view

Price page

which has a link to download a free demo zip file at

any time.

Free demo

includes:

• A live version of the software

• Sample records

• Ability to run all reports

Questions?

1-800-245-8444 or

email

Support@fdssi.com

|

|

|

|