Corporate Debt Issuers

Costs Amortization Software

Utilize GAAP effective interestmethod or Straight Line method at the

file, debt record or individual cost, premium, discount

level

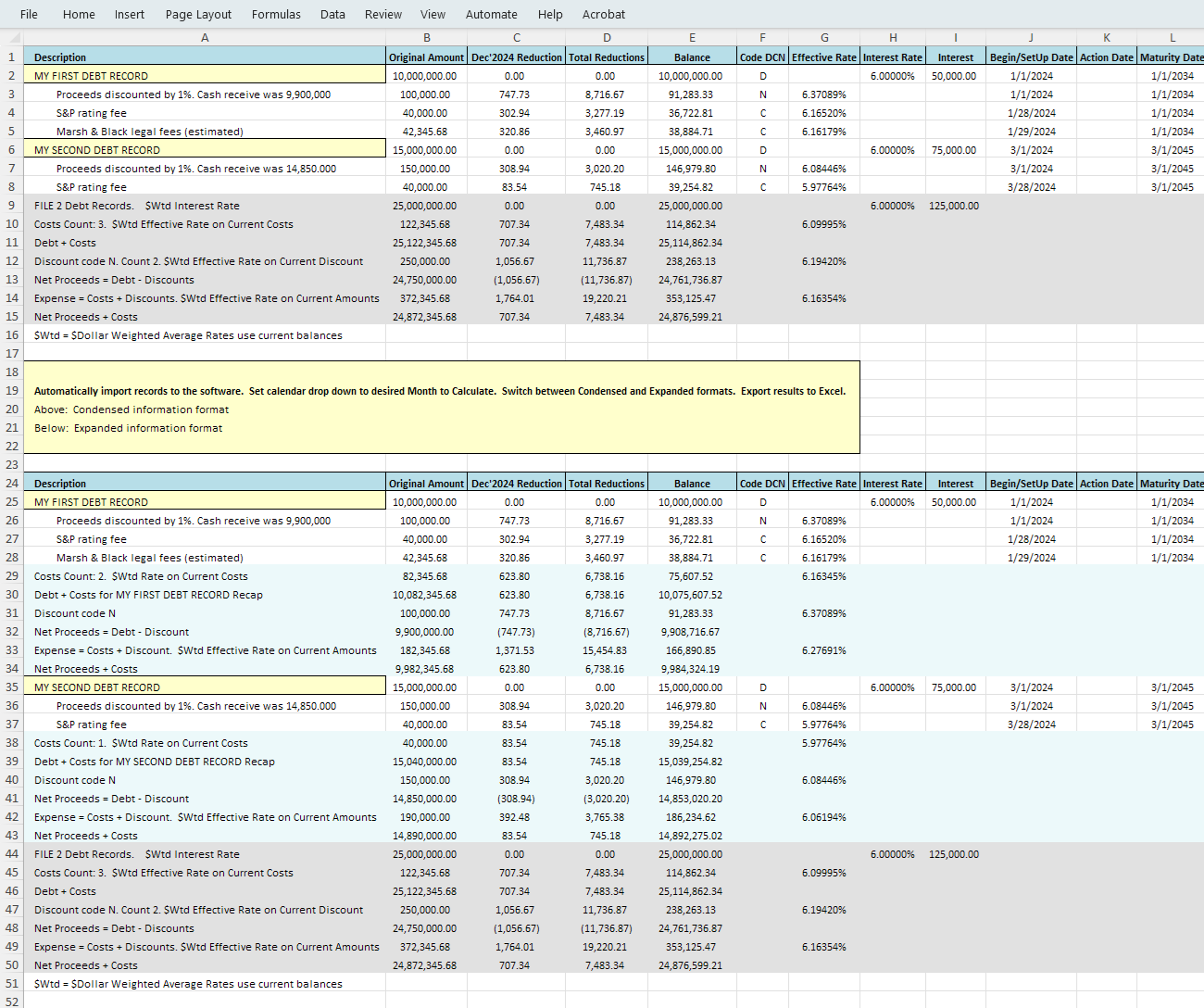

Scheduled and non-scheduled partial calls/redemptions/repayments, refinances and/or

rate changes

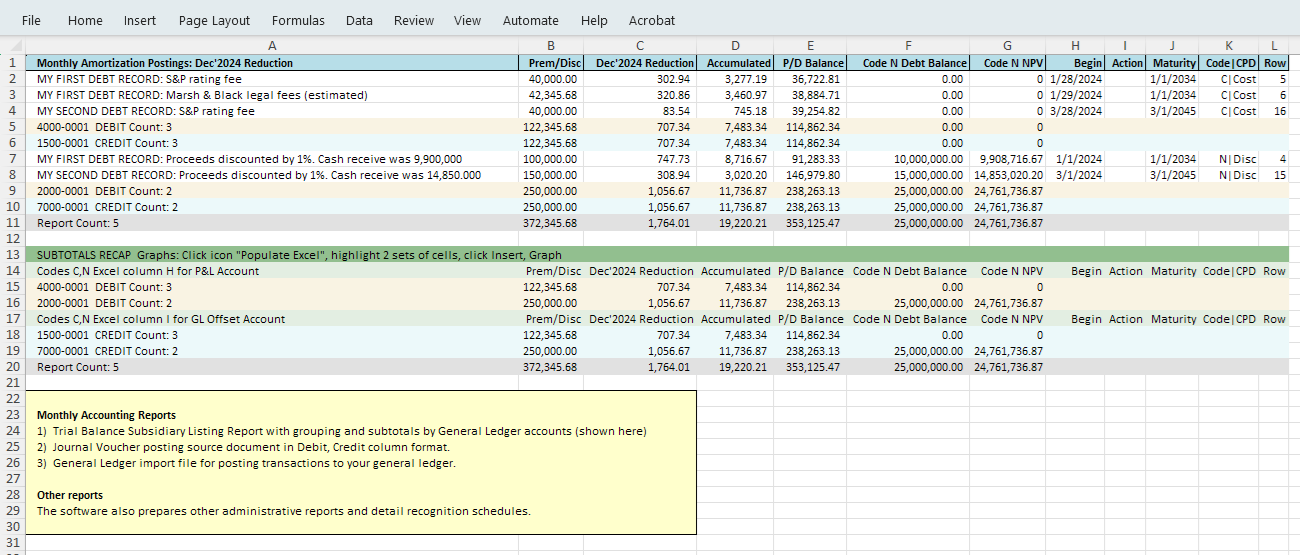

REPORTS LISTING

1) Monthly Posting: Costs,

Premiums, Discounts Amortization

Report. Followed with Journal

Voucher then General Ledger

Posting file.

Column A codes C & N: Costs plus

Premium amortization and

discount accretion recognized

for the selected calendar

calculation month. Records will

be sorted by the values in

spreadsheet column "H P&L

Accounts" within "column I

Offset Account". Totals will be

provided for each account.

A Journal Voucher and General

Ledger posting file will also be

created.

This report can also provide

Costs, Premium and Discount

totals by general ledger

accounts at any time.

(after the report is produced,

click "Escape" to cancel Journal

Voucher processing).

2) Monthly Posting: Accrued

Interest Report. Followed with

Journal Voucher then General

Ledger Posting file.

Column A code D: Requires values

in Debt columns J Payment Due

Date and K Payment Frequency.

The system determines the amount

of Debt interest to accrue for

the selected dropdown Calendar

month. Also provides "Total

Accrued" for balancing to

payable accounts.

Records will be sorted by the

Debt record values in column L

Interest Accrual P&L Account and

column M Interest Accrual Offset

Account. Totals will be provided

for each account. A Journal

Voucher and General Ledger

posting file will also be

created.

The report consists of records

with a Begin Date equal to or

earlier than the dropdown

Calendar month. Records which

have finalized in or prior to

the Calendar month will be

excluded.

The Accrued Interest report and

Accrued Interest Reversal report

(below) eliminate the need to

reconcile Interest Payable

accounts each month. Simply post

cash interest payments to an

expense account. The system will

"undo" previous accruals in an

Interest payment month.

3) Monthly Posting: Accrued

Interest Reversal Report.

Followed with Journal Voucher

then General Ledger Posting

file.

Column A code D: Requires values

in Debt columns J Payment Due

Date and K Payment Frequency.

The system determines the amount

of accrued interest to reverse

for records with an Interest

Payment date during the selected

dropdown Calendar month.

Subtotals are provided based on

values in spreadsheet column T.

Reversal amounts consist of

accrued interest previously

posted by the system for ALL

prior months (since the prior

Interest payment month).

The system calculates running

accrual for Debt through the

preceding month to determine the

amount to reverse (do not delete

a Debt record from the

spreadsheet until after running

this report).

Records will be sorted by the

Debt record values in

spreadsheet column L Interest

Accrual P&L Account and column M

Interest Accrual Offset Account.

Totals will be provided for each

account. A Journal Voucher and

General Ledger posting file will

also be created.

The report consists of Debt

records with a Begin Date equal

to or earlier than the calendar

month. Records which have

finalized, such as matured, in

months PRIOR to the calendar

month will be excluded.

4) Debt Balancing Report. Book

Value and NPV Balances.

Subtotals by Debt column H

account OR "N" records Offset

account column I.

Codes D and N: Subtotals within

Debt column H general ledger

account or "N" code Premium and

Discount records column I.

Original and current balances

for Debt, Premium and Discount

balances and NPV Book Values.

This report is typically used to

balance Book Values when

Premiums and Discounts are

involved.

Set dropdown Calendar date to

any month. Set Months to

Calculate to a value of 1

through 60 months to obtain

future projection results.

5) Summary Report: Debt with

Costs.

Column A codes D and C: Original

and current balances for Debt

plus all Costs. Subtotals for

each Debt record.

Option to run as "Cost Totals

only" which combines Costs on a

single line for each Debt

record.

If Costs exist, separate rows

for Debt and total Costs amounts

will be provided.

Note: Code N Premium and

Discount records are excluded

from this report.

Set dropdown Calendar date to

any month. Set Months to

Calculate to a value of 1

through 60 months to obtain

future projection results.

6) Summary Report: Debt with

Costs, Discounts, Premiums, Net

Proceeds.

Column A codes D, N and C:

Original and current balances

for Debt, premiums, discount and

all Costs. Subtotals for each

Debt record.

If Costs, Premiums or Discounts

exist, separate rows for Debt

and those total amounts will be

provided.

If Premiums or Discounts

involved, also provides Costs

related to Net Proceeds (cash

received).

Set dropdown Calendar date to

any month. Set Months to

Calculate to a value of 1

through 60 months to obtain

future projection results.

7) Cash Outflow Projection

Report: Interest payments plus

Debt reductions for the

reporting period.

Cash Outflow Projection for

interest payable, interim Debt

and maturing reductions and

remaining Debt balance at end

period.

Set dropdown Calendar month to

Beginning month. Set "Number of

Months" to calculate from 1 to

60 months.

Records having a zero Debt

balance at beginning of period

will be excluded.

8) Matured Records Report

showing Debt record balances

that dropped to zero during the

reporting period.

Debt records which matured or

otherwise paid off during the

reporting period.

Similar to "Cash Outflow

Projection report" but includes

only records where Debt dropped

to zero within the period.

9) Interest Payable Report for

Debt records having an interest

payment due this month.

Debt records having an interest

payment this month.

Similar to "Accrued Interest

Report" but includes only

records having an interest

payment due.

There are no general ledger

postings involved.

Options

for existing records

Option 1

The software can calculate

records using original

information.

Amortize

costs, premiums and discounts from original dates.

Book any variances from

software results to your

existing balances.

Option 2

Preserve current

balances.

Begin amortizing from an

"as of" date using current

balances.

|