|

Bond accounting software for purchased bonds and

other investments

Straight Line Method

Easily manage dozens, hundreds, thousands of

investments

• Premium amortization

• Discount accretion

• OID for applicable bonds

Coupon

interest

• Total cash due this month

• Total earned since previous payment

• Accrued monthly interest

Individual bond + file totals for

• Any month

• Entire calendar or fiscal year

• Other periods from any month ranging up to 60

months

• Generate results

in a

matter of seconds

Account

for

Corporate bonds

Municipal bonds

Callable and non-callable bonds:

With or

without a call price

With

or without OID (original

issue discount also amortized by the software)

Partial calls, early

redemptions, partial sales

Convertible bonds

The software calculates a

constant rate to maturity using initial and convertible rates

Hospital bonds

Agencies

Treasuries

Bills

Notes

Special issues

Other investments with

or without

reductions to par

Virtually any premium or

discount instrument

having

Fixed rate

Variable

rate

Zero rate

Convertible rate

360, 365, 366 day basis

Monthly

and yearly

Premium

amortization

Discount

accretion

Earned interest

360 day years (default)

and 365, 366 day basis at the record level

Monthly totals

Yearly totals

Calendar and fiscal period book values, cost basis, carrying balances

Monthly reports

Annual reports

Detail month-by-month audit recognition schedule for

any record on

demand

Already

amortizing

premiums

and

discounts?

The

software

can

preserve

current

income

and

expense

deferral

balances.

No

adjusting

journal

entries.

The

software

can also

amortize

premiums

and

discounts

from

original

begin

dates.

|

Reports

....

User

defined

subtotals

listing

Discounts:

All

bonds

with

discounts

and

subtotals

by

desired

category

Par, Original Discount,

Discount

Accretion,

Discount

Balance,

Cost

Basis

Book

Value

Premiums:

All bonds with premiums and subtotals by desired

category

Par, Original Premium,

Premium

Amortization,

Premium

Balance,

Cost

Basis

Book

Value

Portfolio totals

Cash Due report

each

month

showing

Coupon

interest

due on:

1st of month

15th of month

Other due dates

Purchased interest due

Par due as a result of:

Maturities

Sales

Calls:

Call

date

reached

Early

call,

redemption

Partial

call,

redemption

Coupon Interest status report

Total amount

earned

to date

Interest earned but

not yet

due

Net

Earnings Recap

Earned interest

Premium amortization

Discount

accretion

Net earnings

Finalized Report

for all

bonds

Matured

Called

Sold

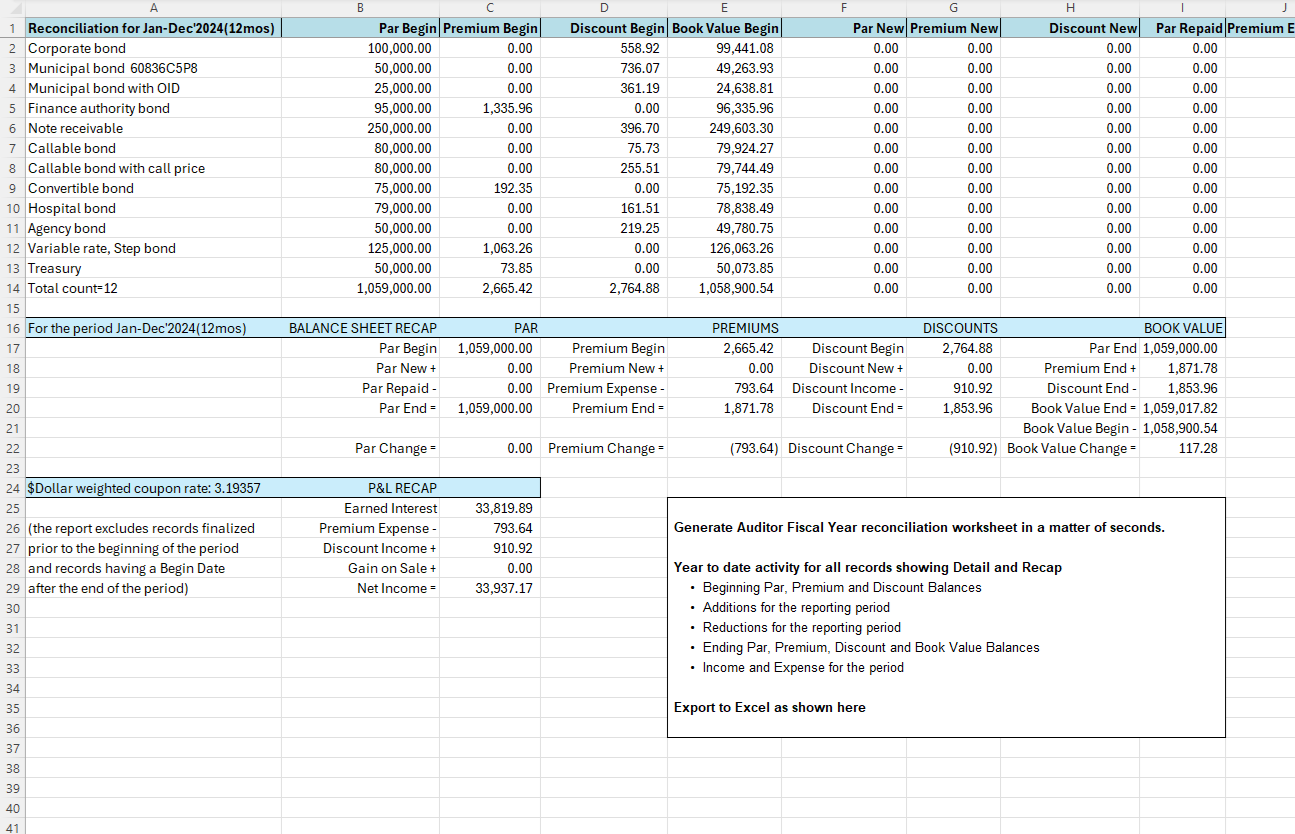

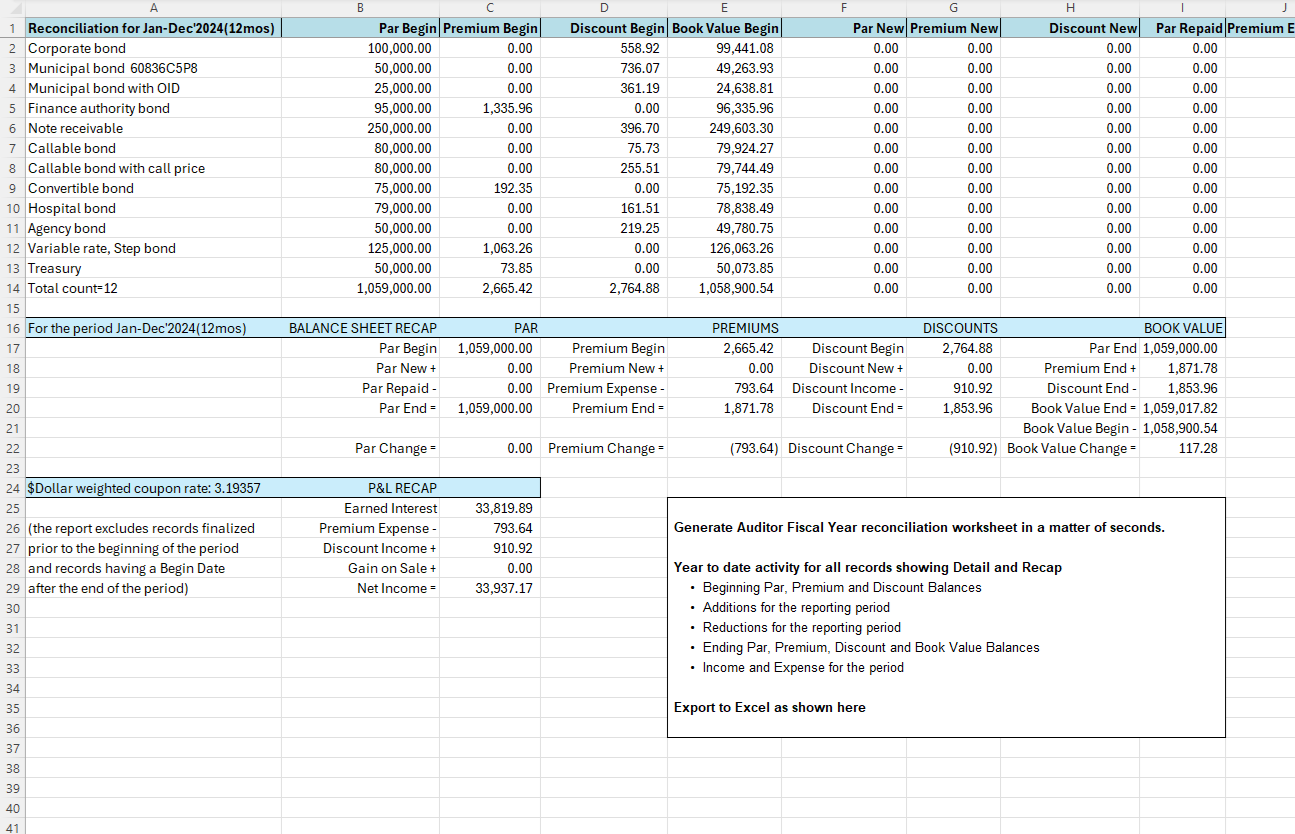

Reconciliation Report

Beginning period balances:

Par

Premium

balance

Discount

balances

Activity

for

period

New

additions

Reductions

to par

Premium

amortization

Discount

accretion

Net activity

Ending

balances

for all bonds and investments

Recap of interest earned

Market Position report

as of a

given

day

Cost

Basis,

Book

Value

compared to

Market

Value

Cost Basis, Book Value calculated as

of any day

With

reports

View

Send to printer

Send to Adobe

Send to Excel

General

Ledger

version

also

includes

Subsidiary Ledger report

Subtotals by user defined

category,

such as

general

ledger

account

Accrued Interest report

Interest earned for the

month

with journal voucher and general ledger posting

file

Journal

Vouchers

General

ledger

posting

files

for:

Premium and discount postings

Interest accrual postings

|

Configurations

and

settings

for ....

Bond holders, individuals, investors, foundations, active traders

Discount accretion income, premium amortization

expense:

Totals for each category

$Dollar weighted rates by category plus portfolio

Group totals for any user-defined purpose

Portfolio Net Earnings:

Interest

+ Discount Income

- Premium Expense

= Net

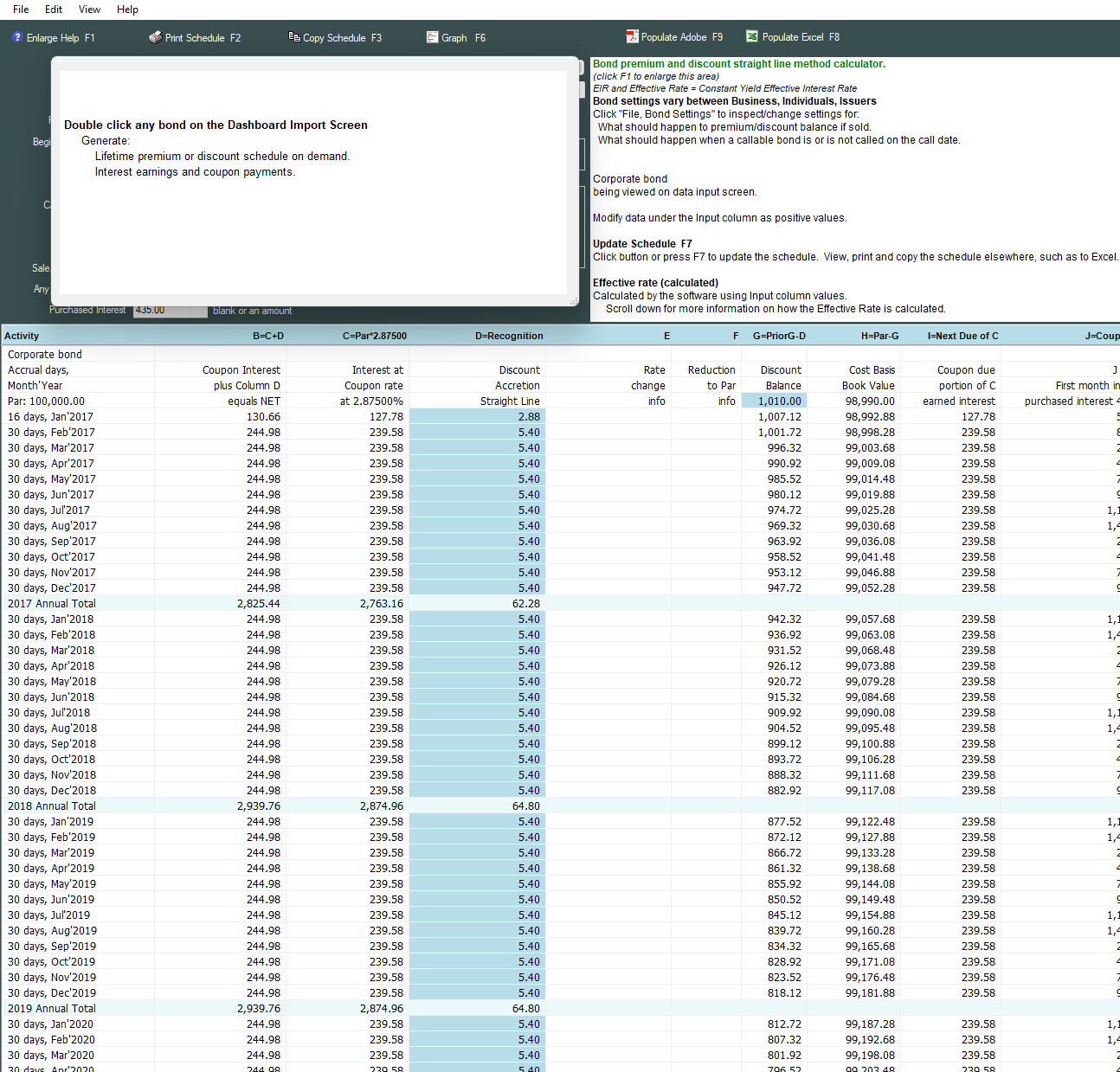

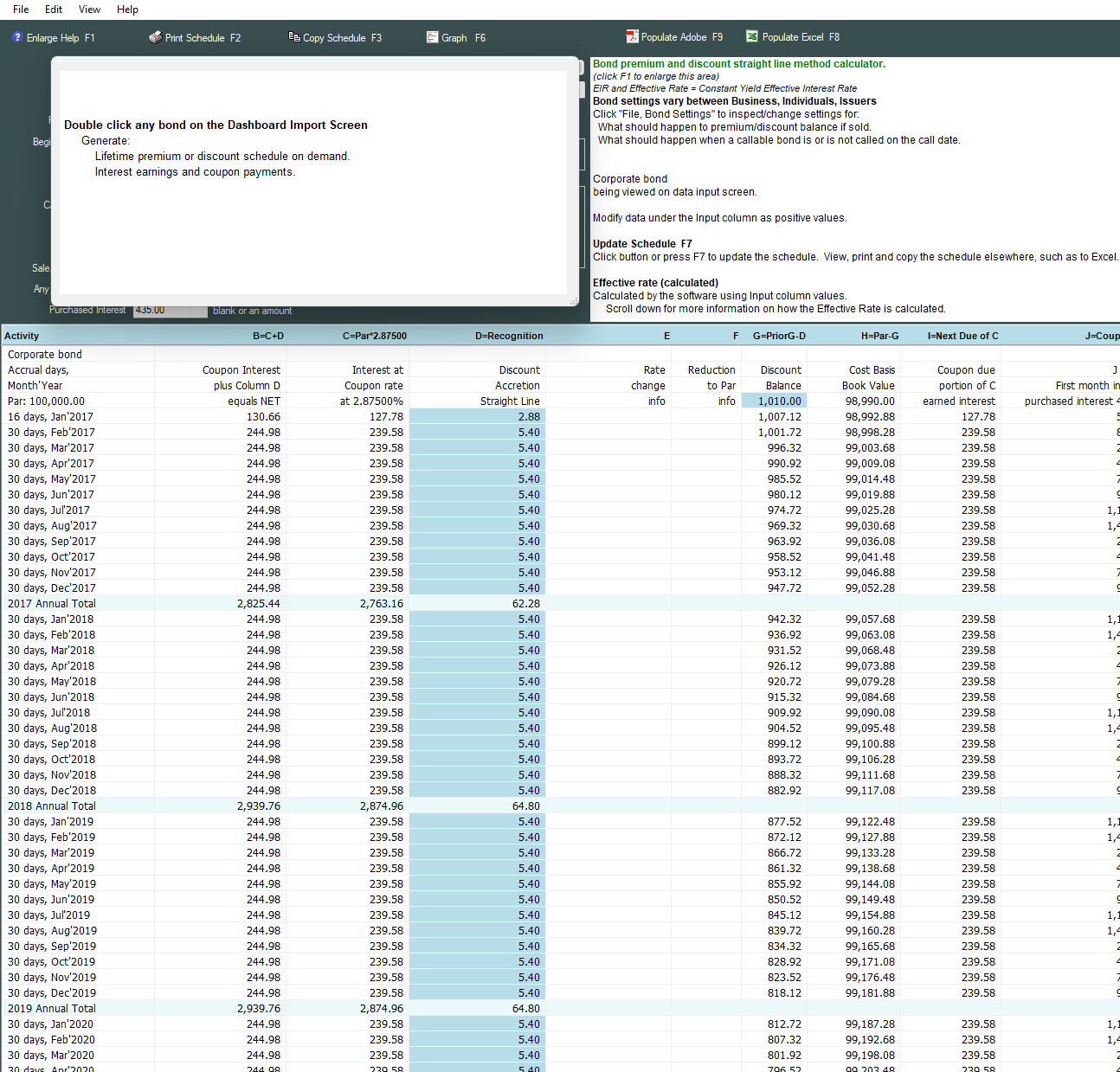

Lifetime month-by-month schedule for each bond:

Audit detail amortization,

accretion schedule for each

record.

Cash due

reporting:

Coupon interest

plus Par due from

maturities,

calls and sales.

Annual

reconciliation

report:

Beginning

balances,

all

activity,

net activity, ending

balances.

Client servicers,

financial advisors, CPA accounting firms

Calculate all of the above for your clients.

Export reports

covering:

Current month and year

Prior months and

years

Future months and years

Amortization and accretion reports can span 1 to 60 months beginning with any month.

View reports

Send to printer

Send to Adobe

Send to

Excel

Business - Add the General Ledger Module for

Subsidiary ledger account listing with:

Monthly recognition

Accumulated

Book value

Par, principal

Balances and totals by each account

Interest

accruals:

Monthly earned income

Accrued receivable balance

Journal vouchers:

Debit, credit columns with totals

General ledger posting files:

Transactions formatted for posting to any general ledger system

Postings in a disk file or automatically exported to Excel

|

|

Price page and free demo .... |

Straight Line Method

Click to open and view

Price page

which has a link to download a free demo zip file at

any time.

Free demo

includes:

• A live version of the software

• Sample records

• Ability to run all reports

Effective

Interest Method

Click to open and view

Price page

Download a free demo from the Price page which

includes:

• A live version of the software

• Sample records

• Run reports

|

Amortization periods

Any prior, current,

future:

Month

Year

Multiple years, calendar or

fiscal for

Each bond

Totals for all bonds

User defined Group totals

Multiple bond files

Interest and rate calculations:

Purchased interest: Track and account for

interest paid at time of

purchase but not yet due

Accrued interest: Current

month income posting plus

Accrued Receivable Account

balances (for business)

Coupon interest: Cash due this

month:

Coupon interest

Purchased interest

Par due to sale, maturity, call

Total

amount of coupon and purchased interest owed

but not yet due

Earned interest:

Coupon

rate earnings for a period irrespective

of accrual or cash activity

Effective interest rate:

The difference between this and

coupon rate determines level

yield recognition

Constant yield rate: Convertible bond earnings

rate blending original and

convertible coupon rates

Portfolio rate: Dollar weighted average

coupon and effective rates for

all investments

Amortize your investments

Software and bonds reside on your computer

Amortize client investments

Import and calculate a file for/from one or

more clients

Prior periods. Current. Future projections.

GROUP

Group bonds and investments. Obtain subtotals by any category.

Examples:

Group = Lot 123, Lot 456, Lot

789 .... (get subtotals

for each lot)

Group = California, New York,

Florida .... (get

subtotals by each issuance

state)

Group = Broker name1, Broker

name 2 .... (get

subtotals by each different

broker)

Group = 2019, 2018, 2017 .... (get subtotals by

each year of purchase)

Group using any category for which

you require subtotals of all

bonds and investments within each Group

Multiple worksheets.

Maintain bonds and investments in more than one

worksheet.

Import and calculate one worksheet.

Import and calculate some or all worksheets.

Call dates:

Amortize to Maturity date or

Amortize to a Call date

including

Call price other than Par

Callable but not called

Partial

calls, early redemptions

Administrative:

Reconciliation

worksheet for audits and exams

Beginning

balances for Par, Premiums and

Discounts

+ Additions

for the period

- Activity

for amortization, accretion,

reductions to Par

= Ending

Balances

Net Change

summation

Mark to Market report - Book Value vs. Market

Value position

Portfolio value as of any given day

Month-by-month recognition schedule

for each bond. Annual subtotals.

Includes a bond amortization calculator for

"what if" questions

What would happen if I sold an existing bond

today?

Should I buy this new bond?

Software and bonds reside on

your system

Copy, export, archive results.

Income and

expense, remaining

balance, book value (cost

basis), earned interest

for each and totals for all records in a

matter of seconds.

From original begin dates

or

Current balances forward, as a conversion

(no journal adjustments)

|

MORE ABOUT

REPORTS ....

• View

• Send to local or network printer

• Automatically export to Adobe

• Automatically export to Excel for internal and

external distribution

Report 1:

Enlarged view of the software import screen

listing

Another view of the Import screen,

primarily so you can sort records by desired

values, such as Coupon rate, Maturity date and

more.

Report 2:

Trial Balance report

Premium, Discount recognition report.

Includes Journal Voucher and General Ledger

Posting file.

Typically for General Ledger Business Version.

Premium amortization and discount accretion will

be recognized for the selected calendar

calculation month. Records will be sorted by the

values in spreadsheet column U general ledger

accounts. Totals will be provided for each

account. Totals will be grouped within Discount

and Premium categories.

A Journal Voucher and General Ledger posting

file will also be created.

For non-business purposes, spreadsheet column U

values can be used to generate subtotals for

other purposes dealing with premiums and

discounts.

Report 3:

Net recap report for calendar month or period

CASH interest +/- Discount, Premium amortization

+/- Net Gain on sale.

Cash coupon interest received during the report

period (the calendar month or number of months)

plus Discount recognition and minus Premium

recognition. The result is NET earnings for the

period based on coupon cash receipts.

Report 4:

Finalized records report

Net Gain or Loss for All records which have

matured or otherwise ended their term.

All records which have reached Maturity date,

Call date, have been Sold, Paid Down to zero,

Redeemed in full or otherwise finished their

term.

Report consists of Net Gain or Loss based on

spreadsheet column M, Gain/Loss on sale and/or

column O, Sale Proceeds.

This report can also be used as a purge list

when beginning a new year. Create a new

spreadsheet with a file name dated for the new

year. Delete records appearing on this report

through the prior year end.

Records will appear in the order they appear in

the spreadsheet in order to facilitate the

above.

ABOUT

COUPON INTEREST: CASH vs. EARNED ....

CASH:

CASH and coupon interest due represent interest

from one coupon payment date to the next.

Actual cash activity and dates need not be

logged (see the following regarding differences

between calculated earned and cash interest

receipts). The system "moves" spreadsheet column

R Payment Due date, along with a prior

due/accrue from date, forward and backward based

on the calendar calculation month.

EARNED:

EARNED interest is the amount to which you are

entitled, typically representing full month

periods but also spanning the entire life of the

record. Interest is always being earned

regardless of whether or not interest is

received as cash (whether it be cash, check,

direct deposit and otherwise). Think of Earned

Interest as having a job where you get paid on

Friday. Come Thursday evening, you have earned 4

days worth of your pay even though you won't get

the cash until Friday.

This system calculates all interest based on

spreadsheet values as they exist when imported.

No calculations, report values or other results

are ever saved from one import to another.

Penny differences will likely arise between

actual cash received and what is calculated by

the system. Substantial differences may need to

be investigated.

Furthermore, coupon interest calculations in

this software should never be used for tax or

other reporting purposes. Instead, obtain and

use the figures provided by the entity

responsible for coupon payment disbursements.

Report 5:

Net recap report for calendar month or period

EARNED interest +/- Discount, Premium

amortization +/- Net Gain on sale.

Earned interest for the report period (the

calendar month or number of months) plus

Discount recognition and minus Premium

recognition. The result is NET earnings for the

period.

Report 6:

Coupon Interest Status report

All coupon interest due since previous payment

minus Cash Due this month.

Requires values in spreadsheet columns R and S

(if columns R and S are blank, records will be

flagged as missing required values).

The system determines the amount of coupon

interest earned through this month including

cash interest due. This furnishes everything

earned and due since prior coupon payment dates.

Records will be sorted by the values in

spreadsheet column T general ledger accounts.

Totals will be provided for each value in

spreadsheet column T.

The report consists of records with a Begin Date

equal to or earlier than the calendar month.

Report 7:

Cash Due this month report

Coupon interest payments plus any par

reductions, sales, maturities occurring this

month.

Requires values in spreadsheet columns R and S

(otherwise, records will be flagged as missing

required values) .

The report includes records having a coupon

payment due date matching the selected calendar

calculation month. The report will also include

interest plus Par for records with a Maturity

date, Sale date or other finalized reason date

falling within the calendar month. Also included

are any Net gain for sold bonds as well as Par

for reductions to Par for the month.

Subtotals are provided based on values in

spreadsheet column T.

The report can be printed and/or exported to

Excel or another spreadsheet, enabling you to

"tick off" cash receivables as they come in (it

is not necessary to update the system with cash

receipts).

Records with a Begin Date later than the

calendar month will be excluded. Records which

have finalized, such as matured or called, in

months PRIOR to the calendar month will be

excluded.

Report 8:

Accrued Interest report (requires General ledger

module)

What was Earned this month. Includes

Journal Voucher and General Ledger Posting File.

Requires values in spreadsheet columns R, S and

T (if columns R and S are blank, records will be

flagged as missing required values).

Typically for business (running this report is

optional and not required for the system to

operate).

The system determines the amount of coupon

interest to accrue for the selected calendar

calculation month. Also provides a "Total

Accrued" which includes applicable Purchased

Interest for balancing to receivable accounts.

Records will be sorted by the values in

spreadsheet column T general ledger accounts.

Totals will be provided for each account. A

Journal Voucher and General Ledger posting file

will also be created.

The report consists of records with a Begin Date

equal to or earlier than the calendar month.

Records which have finalized, such as matured or

called, in or prior to the calendar month will

be excluded.

RECONCILING RECEIVABLE ACCOUNTS: The Accrued

Interest Report provides a subsidiary listing

for general ledger receivable accounts.

CASH INTEREST RECEIVED: Interest receipts can be

posted directly to income.

The Accrued Interest report and Accrued Interest

Reversal report (below) eliminate the need to

reconcile cash receipts to receivable accounts

each month.

Report 9:

Accrued Interest Reversal report (requires

General ledger module)

Reverse accruals for Cash Due that has been

received. Includes Journal Voucher and

General Ledger Posting File.

Requires values in spreadsheet columns R, S and

T (if columns R and S are blank, records will

not appear on this report).

Typically for business (running this report is

optional and not required for the system to

operate).

The system determines the amount of accrued

interest to reverse for the selected calendar

calculation month.

Subtotals are provided based on values in

spreadsheet column T.

Prior month accruals are NOT being reversed.

Reversals are created ONLY for records having a

coupon payment due plus Matured, Called, Sold

and records which Paid off in the selected

reversal month.

Reversal amount consists of accrued interest

previously posted by the system for these

records for ALL months, including Purchased

Interest posted by you.

The system calculates running accrual for bonds

through the preceding month to determine the

amount to reverse (bonds with accrued interest

should not be deleted from the spreadsheet until

reversals have been done).

Records will be sorted by the values in

spreadsheet column T general ledger accounts.

Totals will be provided for each account. A

Journal Voucher and General Ledger posting file

will also be created.

The report consists of records with a Begin Date

equal to or earlier than the calendar month.

Records must also have a Coupon Due date in

spreadsheet column R and a column S code greater

than 0. Records which have finalized, such as

matured or called, in months PRIOR to the

calendar month will be excluded.

Report 10:

Reconciliation Report for any month or annual

period - Beginning balances plus activity for

the period.

Balances at the beginning of the desired period,

plus additions for new records during the

period, minus activity equals ending balances.

Primarily used for reconciling changes to

Balance Sheet accounts.

Report 11:

Market Position Quote report. Compare Market

Quote to Cost Basis calculated as of calendar

'did' day.

The system will compare a Market Quote for a

bond to the Cost Basis calculated as of (TO) the

'dd' date portion of the calendar date. Premiums

and discounts are not recognized for the 'dd'

date.

Determine your portfolio position for each bond,

with a total for all bonds.

|

|

Price page and free demo .... |

Straight Line Method

Click to open and view

Price page

which has a link to download a free demo zip file at

any time.

Free demo

includes:

• A live version of the software

• Sample records

• Ability to run all reports

Effective

Interest Method

Click to open and view

Price page

Download a free demo from the Price page which

includes:

• A live version of the software

• Sample records

• Run reports

|

If you

don't see what you need ....

Special project?

Pressed for time?

We offer

•

Bond calculation services on a one-time or

recurring basis

• Software customization

• Other amortization software products

For more information,

email

Support@fdssi.com

Software and Price

•

Software and bond files reside on your

computer

• Software for Windows® software

on a computer,

laptop and network sharing systems

General Ledger

Module

•

Trial Balance subsidiary listing report - par,

book value, premium and discount balances within

each account

•

Journal Voucher with debit, credit posting

columns

•

Accrued interest calculations and reports

•

Auditor worksheet - Reconciliation Report for

any month or entire year:

•

Balance Sheet: Beginning

balances, new additions, reductions,

recognition, ending

balances

•

P&L: Interest, premium expense, discount

income, gain/loss on sales, net income for the

period

•

Each bond plus File Totals Recap

Records retention

• No need to save reports

or schedules on paper

• Hard copy retention can be

eliminated

• Whenever a report is needed for

any prior month, year or other period:

1) Import the applicable Excel

file containing your bond portfolio at

that time

Many clients "save as" and create a

new file each year, and then delete

matured and sold bonds from the new

file.

2) Set the software dropdown

calendar date to the desired reporting

month, year

3) Run reports and schedules

Daily

cost basis, book value

• Current

portfolio value

• Comparison

of Cost Basis/Book Values to Market quotes as of

a given day

Enter market quotes or

Retrieve using Excel's RTD function to obtain

quotes from an on-line source

• Gain or loss if

sold column

• Each bond

• Portfolio totals

• Daily Cost Basis/Book Value listing for any

date

• EOM Mark to Market reporting

Accounting services firm?

Financial advisor?

Do you prepare amortization reports for another

party?

• Import client

bond file to the software

File can be maintained by you or

File can be maintained by client and emailed to

you

• Generate

monthly, yearly bond amortization and other reports

• Export results to Excel

• Email to clients

|

Price

Straight Line Method

Click to open and view

Price page

which has a link to download a free demo zip file at

any time.

Free demo

includes:

• A live version of the software

• Sample records

• Ability to run all reports

Effective

Interest Method, level yield

Click to open and view

Price page

and download a free demo

right now

Bond file

calculation services

We can calculate a bond file on a one-time

basis.

Premium and discount amortization for a month.

For an entire calendar/fiscal year.

Reports and supportive data are provided in

Excel.

For more information, Email

Bond file calculation services

Questions?

Don't

see what

you

need?

1-800-245-8444

or email

Support@fdssi.com

|

|

|

|

|