|

Expenses, Cost

Amortization

Software

View

Price page

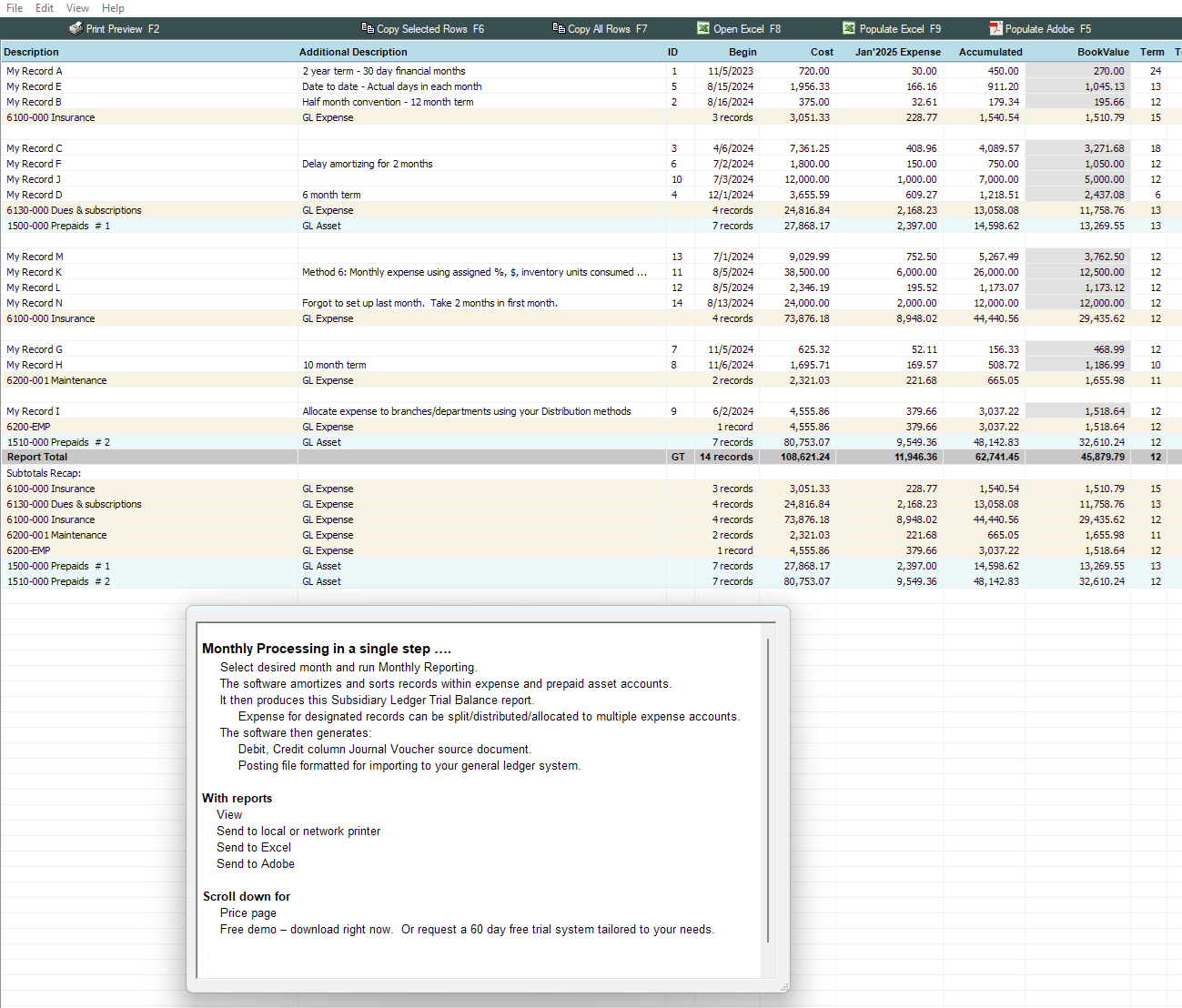

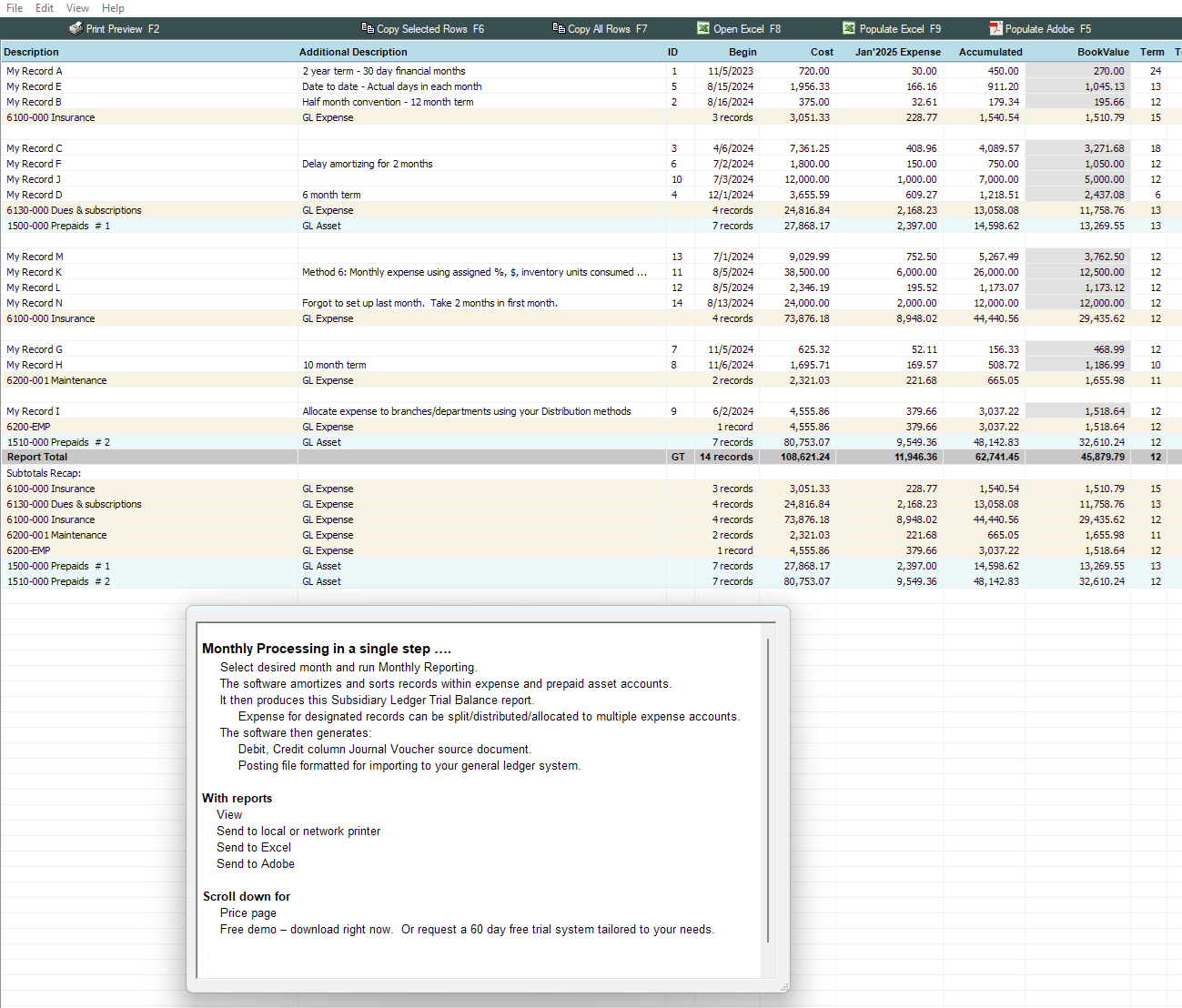

Generate a complete set

of monthly reports in

minutes ....

1)

Amortization for all

records at the same time

2) Subsidiary ledger report with general ledger

subtotals

3) Split, allocate expense to multiple general ledger

accounts

4) Journal Voucher debit, credit column posting source

document

5) Posting file to update your general ledger using

Excel or disk file

Prepaid

expenses

Deferred

charges

Capitalized costs

Insurance

premiums

Maintenance

agreements

Office supplies

Dues, memberships |

Recurring items,

fixed/variable

Intangible

assets

License

fees, retainers

Marketing,

promotions

Assessments

Software, programs

Hardware

fees |

Prepaid rent, occupancy

Upgrade charges

Donations, gifts

Security

charges

Incorporation costs

Subscriptions

Any

expense over

time |

|

Meets

requirements for

GAAP

Record

keeping,

amortization

schedules,

subsidiary

ledger, journal

voucher, auditor

worksheet

recap and more.

AICPA

Many of our

clients are CPA

firms importing

client records

from Excel to

prepare monthly

financial

accounting

reports.

SOX - Sarbanes

Oxley

History

archiving

electronically

preserves all

reports for

recall at any

future date.

Available as

BASIC SYSTEM

Monthly amortization and reports

which satisfy

the need of most

clients.

ADDITIONAL MODULES

For clients requiring one or more

specific

functions such

as allocating amortized

expense to multiple

branches.

Existing records

Add new and existing records to the software.

Import and convert records in Excel.

Preserve current Book Values for either.

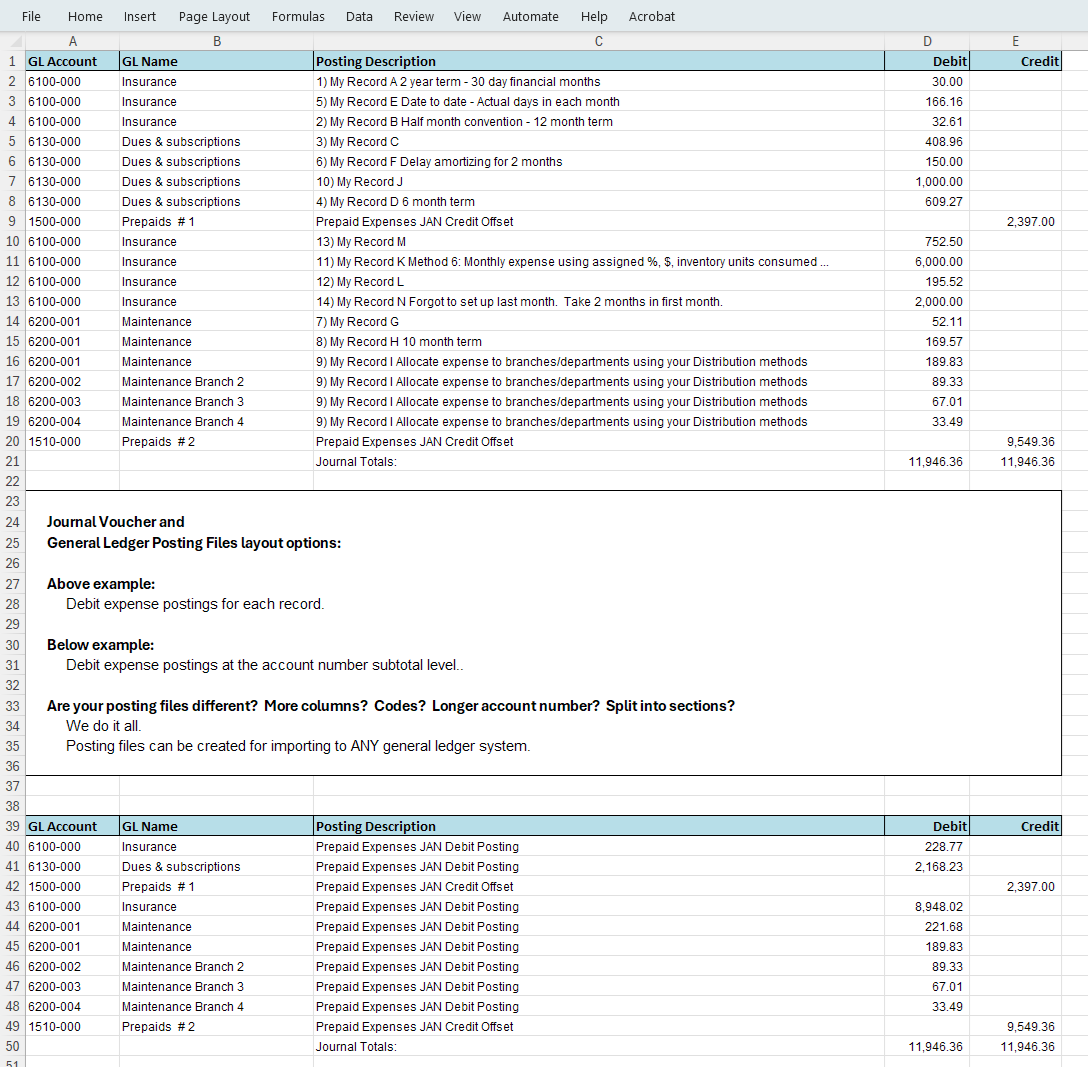

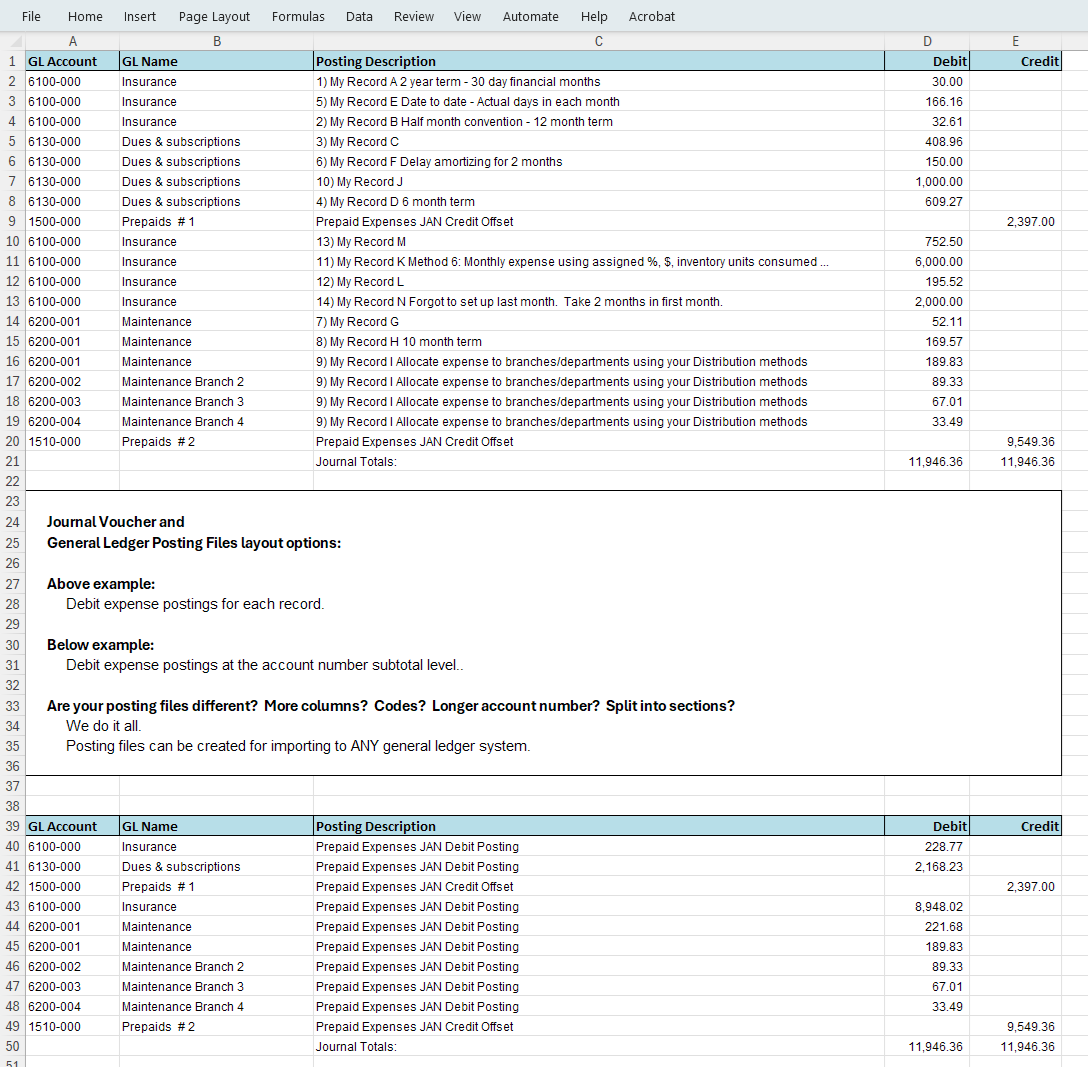

General Ledger Posting Files for ANY

general ledger system using ANY chart of

accounts

Posting

transactions can consist

of:

1) Expense debits and Prepaid Expense offset

credits are subtotal

amounts for each general

ledger account.

2) Expense debits are for EACH Prepaid Expense

record. Offset

credits are subtotal

amounts for each general

ledger account.

3) Expense debits are for EACH Prepaid Expense

record. Offset

credit for EACH

record.

Supports ANY

general ledger import format:

Multiple columns.

Dots. Dashes.

Split values.

Leading

zeroes. Trailing zeroes.

Disk file.

Worksheet. D/C.

Signed. (Credits).

Fixed length.

Excel. Tab

delimited. Comma

delimited.

Other

delimiters.

Split general ledger account numbers into

multiple

columns.

Branches. Departments. Divisions.

Types.

Codes.

Other

user

defined

requirements.

Expense distribution, splits, allocation to

multiple

general

ledger

accounts.

We provide or create

ANY format suitable for

suitable

for

updating ANY

general ledger system.

Allocate

amortized expense

Distribute

one or

more

general

ledger

posting

amounts

to

multiple

branch,

cost,

revenue

and

other

centers

using

one or

more

Allocation

Methods

maintained

in the

software.

You

assign

each

Method a

name

that is

meaningful

to you,

perhaps

"SQ" to

mean the

Allocation

Method

is based

on the

amount

of

square

feet

occupied

by a

department.

Or "EMP"

to

allocate

using

the

number

of

employees

in each

branch.

Each

Method

contains

your

chart of

account

branch

numbers

(or

cost/revenue

center

numbers

or ....)

along

with the

number

of units

each

contains,

such as

square

feet,

employee

count

and even

your own

assigned

percentage.

Any type

of

numerical

values.

To

allocate

a

record,

merely

replace

the

branch

portion

of a

general

ledger

account

number

with the

Method

name.

The

system

will

calculate

the

percentage

being

allocated

to each

branch

based on

number

of units

and

create

multiple

posting

records,

each for

smaller

amounts

that add

up to

the

original.

|

Basic

System

consists

of these

features

Records:

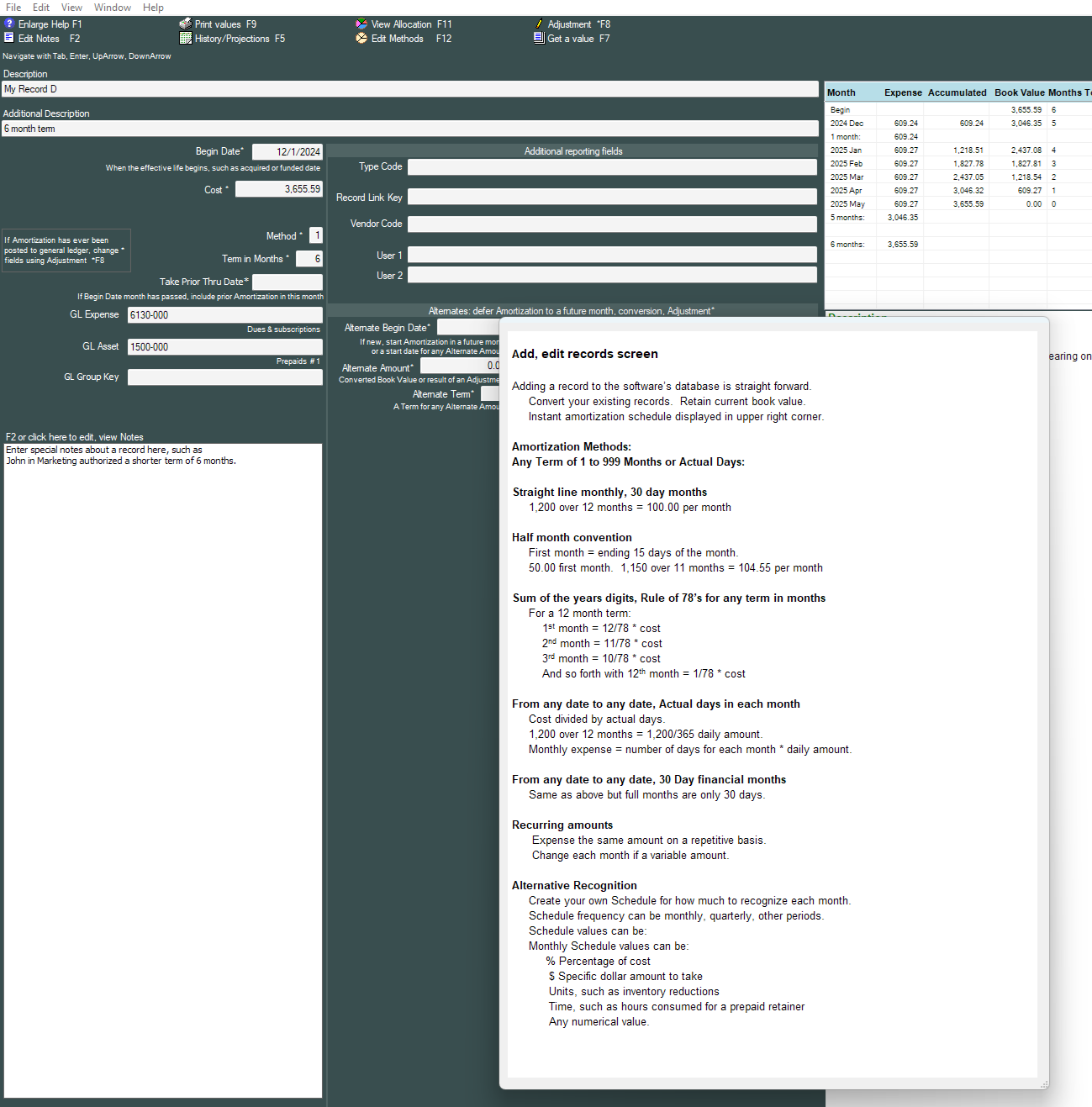

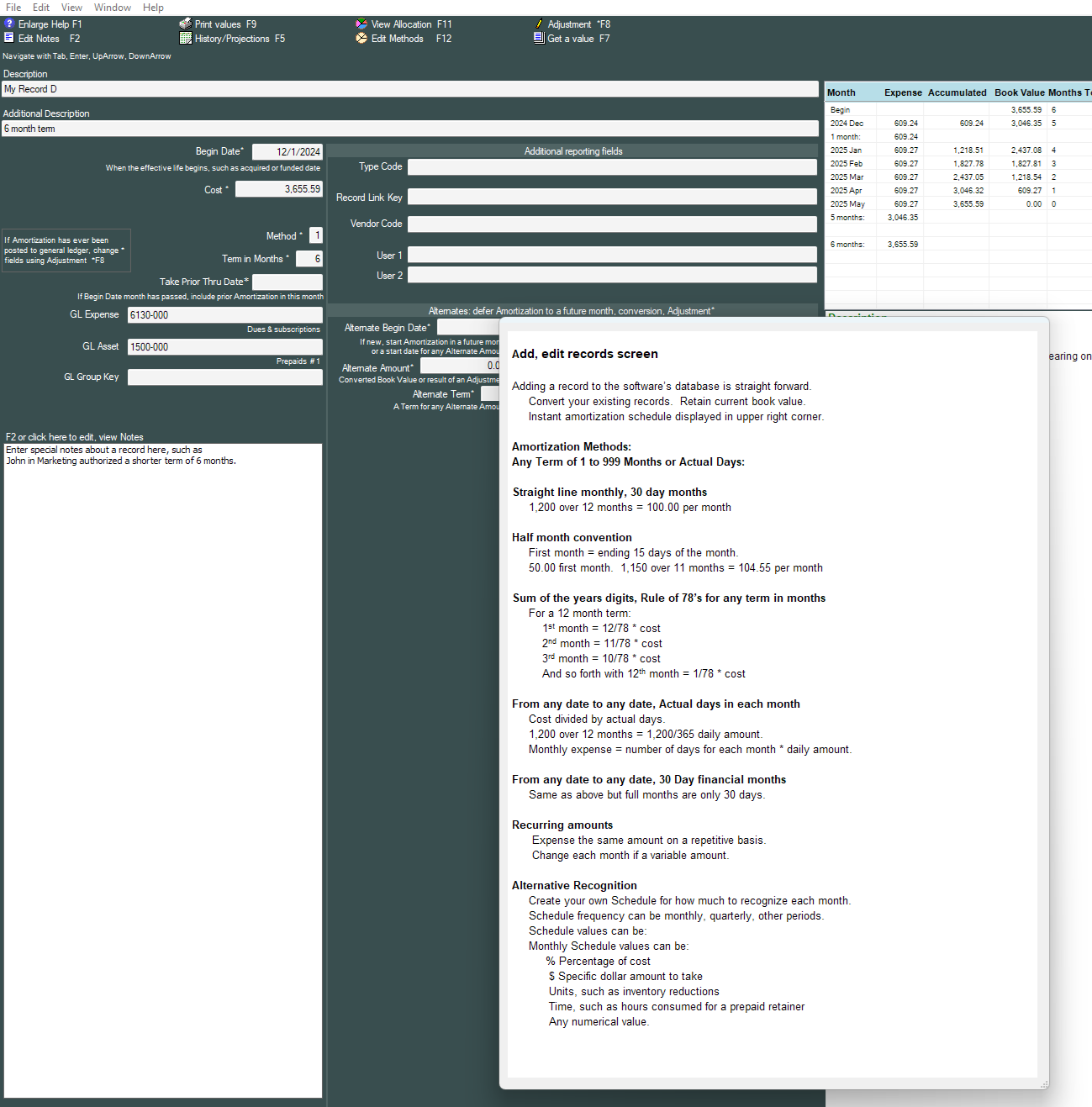

Amortization

and

monthly

reporting.

Add

records

in any

order.

Sort list by any column value

Book

values.

Preserve current book values or

Software can calculate records current from original

begin

dates

New

record:

Capture

prior

months

expense

if set

up late.

Defer

amortizing

to a

future

"in

service"

future

month.

Data validation:

A date must be a valid

date

A dollar amount must be a

valid

number

Instant

amortization

schedule

Helps prevent set-up errors by seeing "what" will occur

each

month

over

desired

term.

Adjustment

screen

with

single

step

entry

to:

Increase

cost,

such as

additional

charges

during

term

Decrease

cost,

such as

partial

refund

during

term

Change

remaining

term

Write-off

this

month

Edit

other

values

at any

time.

Delete

old

records:

Sort by book value

Delete 0.00 book values in a single step

Supports

any

chart of

accounts:

General

ledger

base

accounts,

branch,

department

and cost

centers

....

Calculation

methods

supported

at the

record

level:

Straight

line 30

day

financial

months

Half

month

convention

Date to

date

actual

calendar

days,

including

half

month

convention

Accelerated

sum of

the

years

digits

(rule of

78's for

any

term)

Reports:

"2

click"

monthly

reporting.

Generate

a report

stream

with two

clicks

of the

mouse

No

monthly

close

out

required.

General

ledger

subsidiary

ledger

trial

balance:

Records

sorted

and

grouped

by

general

ledger

accounts.

Debit

and

credit

Journal

Voucher

postings

General

ledger

subtotal

level or

individual

posting

for each

record

General

ledger

base

accounts,

branch,

department,

cost and

revenue

centers

....

Calculations

for

future

time

periods

New

records

report

Additions

for any

time

period,

such as

year to

date,

grouped

by

general

ledger

account

Review

date

Automatic

Review/Maturity

date

calculation

with

tickler

report

MySubtotals

report

Group

and

subtotal

records

by any

field

value

Filters:

Create

selective

reports

using

field

and date

filters

|

Administrative reports

New records: List new records for the month,

Y-T-D and other time periods

Maturity/Review

date: A tickler file showing records that are

nearing the end of their term

Vendors: If desired, add vendor name or

code and get a list of total

cost for each vendor

Type: If desired, assign a type code to

group records for desired

purpose other than expense

account

Link: If desired, tie records together by

a common purpose, such as all IT

and other department costs

Alpha: Alphabetical listing of

records in

description

order

Filters: Alpha and monetary values, dates

and date ranges

Select all records for a report

or

Use one or more filters to only

included specific records, such

as cost > $1,000.00

Reconciliation: Beginning balances, new

records, amortization, ending

balances for month, year

MySubtotals: Filter and obtain records

and subtotals sorted by

selected values on the fly

MyReports: Create and retain reports,

filters and sorted subtotals you

need for repetitive runs

Records only or Subtotals only: Run

reports with or without

individual records for "Totals

only" (shorter report)

Amortization periods: Expense plus ending

book values for 1 month, range

of months, entire year

Columns: Expense for multiple months,

entire year, displayed in

multiple monthly columns, past

or future

With reports:

View

on screen

Send to printer

Export to Excel

A great way to respond to a

request from your boss

Or export all or filtered

records and do whatever

reporting you want in Excel

Export to Adobe

|

|

Price page and free demo .... |

Price page

with free demo

Click to open and view

Price page

which has a link to download a free demo zip file at

any time.

Free demo

includes:

• A live version of the software

• Sample records

• Ability to run all reports

Questions about your needs?

Call 1-800-245-8444 or

email

Support@fdssi.com

|

Assign Amortization

Methods at the record

level

1) Straight Line: 30 day

financial months. Same

amount each month. Any

odd amount is taken in

the first month.

1,200.00 over 12 months

= 100.00 per month.

2) Begin Date TO

Review/Maturity Date:

All months are 360 day

basis (internally, a

date of the 31st is

changed to the 30th).

Partial first month and

partial last month

recognition supported.

Any odd amount may be

taken in first and/or

final month. Begin Date

is included.

Review/Maturity Date is

TO, not Through. If

dates are the same,

nothing will be

recognized.

For Half Month

convention: Set Begin

Date to 16th. For a 12

month term, set

Review/Maturity Date to

1st of the month

following the 12th

month. For "in service"

period of one year, set

Review/Maturity Date to

the 16th of the Begin

Date month plus 1 year.

3) Begin Date TO

Review/Maturity Date:

All months are actual

days, 365/366 basis.

Partial first month and

partial last month

recognition supported.

Any odd amount is taken

in final month. Begin

Date is included.

Review/Maturity Date is

TO, not Through. If

dates are the same,

nothing will be

recognized.

4) Accelerated, also

known as

Sum-of-the-years digits

(S-Y-D): More is taken

in first month, then

declines. Any odd amount

is taken in final month.

1,200.00 over 12 months

= 12/78 for the first

month, then 11/78, then

10/78 and so forth.

5) Recurring item or

don't perform any

calculations: Use

Calculated field values

which you enter.

Typically represents a

record created for

balancing purposes or a

recurring amount when

Expense contains a

value.

Consider Method 5 as a

"wildcard" wherein the

software will report

whatever is entered into

the record.

Method 5 Review Date is

for Review Date

reporting only and does

not "end" a recurring

status. Begin Date,

Alternate field values

and Take Prior Thru date

are ignored.

6) Alternative

Recognition of Cost

based upon Total Units

and Monthly Units, also

known as

"Amortize cost however

your boss tells you to"

including monthly,

quarterly, semi-annual

.... Any

frequency.

The system can recognize

Cost based upon a count

of Total Units reduced

by Monthly units

(including 0) which are

used or consumed in a

given month.

Total Units - A positive

number

Total Units might

represent:

● Percent, where Total

Units = 100

Monthly Units are the

percent of Cost to

recognize in each month.

● Prepaid service, where

Total Units might =

Hours (such as 650

prepaid professional

services)

Monthly Units are the

number of hours utilized

or consumed.

When the record is first

entered to the system,

"hours utilized" are

likely to be unknown.

Simply enter zero for

Month1 Units. As "hours

utilized" become known,

enter the hours into the

appropriate Monthly

Units category.

● Inventory, where Total

Units = Inventory Count

(such as 2,950 widgets)

Monthly Units are the

count of items removed

from inventory and

entered each month.

Inventory can refer to

any physical count,

including office

supplies, such as

prepaid ink cartridges

and other expensive

items retaining a value.

● Dollar amounts, where

Total Units might = Cost

Monthly Units are

specific dollar amounts

to recognize each month.

● Virtually any other

type of Units.

The system recognizes

monthly Amortization by

multiplying Cost times

(Monthly Units / Total

Units) where the "/"

means "divided by".

(Monthly Units / Total

Units) derives a

percentage. In effect,

all Amortization

utilizing Method 6 is a

reduction by percentage.

When the sum of Monthly

Units is less than Total

Units, the system

recognizes remaining

Book Value in the final

month.

And, as discussed below

under "Extend the Term",

if Monthly Units are not

entirely consumed during

the initial Term, you

can extend the Term

which will also extend

Book Value Amortization.

Monthly Units -

Positive, negative or

zero

Positive, to reduce

Total Units remaining.

Negative, to increase

Total Units remaining

(typically to correct an

error or return).

When Monthly Units are

negative:

Remaining Units will be

increased.

Amortization for the

month will be negative.

However, it will not

exceed the prior month's

Accumulated

Amortization. In other

words, Book Value will

increase but not exceed

original Cost.

0, meaning zero units

were used in a month. No

Amortization will be

recognized.

Zero Monthly Units also

allow Amortization to be

recognized other than

monthly. Use zero

Monthly Units to "skip"

months, thus

accommodating Quarterly,

Bi-Monthly and other

Amortization

frequencies.

Monthly Units - Unknown

Current and future

Monthly Units can be

blank (nothing - no

entry or 0), meaning

Monthly Units have not

yet been determined.

Example:

Total Units = 960 based

upon future reductions

at an unknown rate.

Set Monthly Units to 0

or leave them blank

(nothing).

At the end of each

month, enter that

month's Monthly Units

including 0 if none were

used.

When Monthly Units are

blank or 0, the system

does not recognize any

Cost. The system waits

until the final month to

recognize any/all

unentered Units, thus

allowing you enter

Monthly Units on a

monthly basis.

Caution: Once Monthly

Posting has been run for

a month, it is too late

to change Monthly Units

from blank or 0 unless

you run another Monthly

Posting (for the same

month).

Non-Monthly recognition

- Quarterly, bi-monthly,

annually ....

Amortization can occur

on an other than monthly

basis.

To accomplish this,

enter Total Units of

100, representing

Percent. Enter Monthly

Units in the months you

want recognition to

occur and zero in the

Months you don't want to

recognize anything.

Example:

Quarterly recognition

Total Units = 100

Set 25 into 4 of the

months, leaving other

months at 0.

Each month with 25 will

recognize 25/100 or 25%

You can enter Monthly

Units (including 0) into

any month to create a

recognition pattern of

any kind and frequency.

Extend the Term:

If Units remain at the

end of the Term, you

can:

1) Do nothing. The

system will recognize

remaining Book Value in

full.

2) Extend the Term (only

if the final month

Amortization has not

been booked to the

general ledger).

On the Field Editing

screen, select

"Adjustment F8" and

extend the Term, then

modify/enter Units for

the additional remaining

Term.

You can Extend the

original Term or

remaining Term at any

time for any purpose

utilizing "Adjustment

F8".

How it works

Each month, the system

divides Monthly Units by

Total Units to derive a

percentage. This

percentage is multiplied

by Cost to determine how

much Cost to recognize

in the given month.

If the total of Monthly

Units is less than Total

Units, the system

recognizes the remaining

Cost in the final month.

The system keeps track

of Total Units and

Monthly Units by

appending the values to

Method in Field 6.

|

Price ....

Click to open and view

Price page

which has a link to download a free demo zip file at

any time.

Free demo

includes:

• A live version of the software

• Sample records

• Ability to run all reports

Questions?

1-800-245-8444 or

email

Support@fdssi.com

|

|

|

|