|

GAAP, FASB software for Merchant Cash

Advances

Definitions:

$25,000.00 = Proceeds check to customer.

$5,000.00 = Profit Discount, a Deferral

to be recognized under GAAP.

$30,000.00 = Face Value, the total

amount to be repaid.

(with respect to

Face Value, the $5,000.00 Profit is a

Deferral being recognized as a Discount).

Amortize

dozens, hundreds,

thousands of MCA deals at the same time

GAAP IRR

Effective Interest Rate calculation for each

record.

Deferred Profit Discount Balance Totals

Other deferred income, expense Balance

Totals

NPV Net Present Value (Face Value +/- Deferral balance)

Daily, weekly, other payment

frequencies.

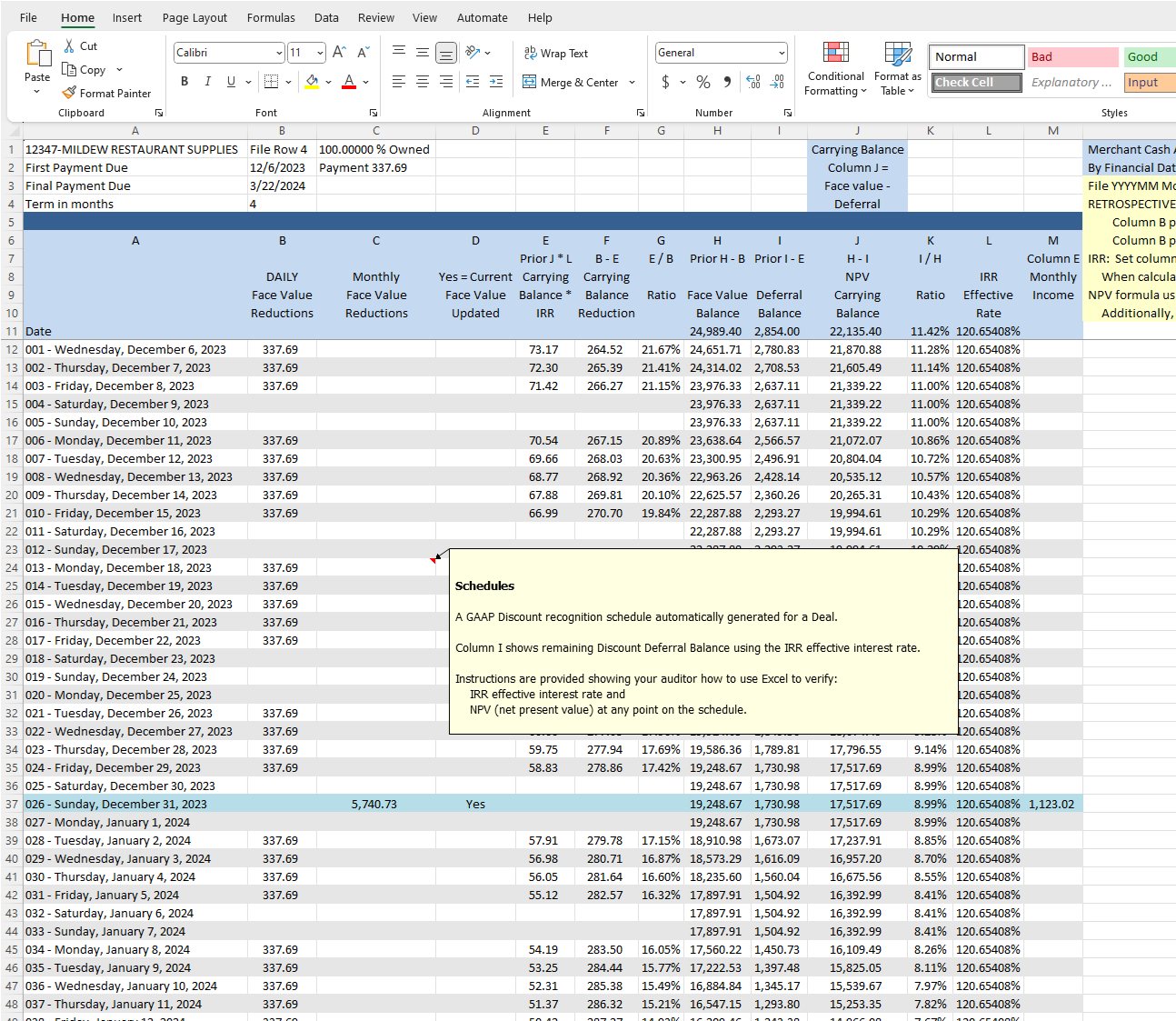

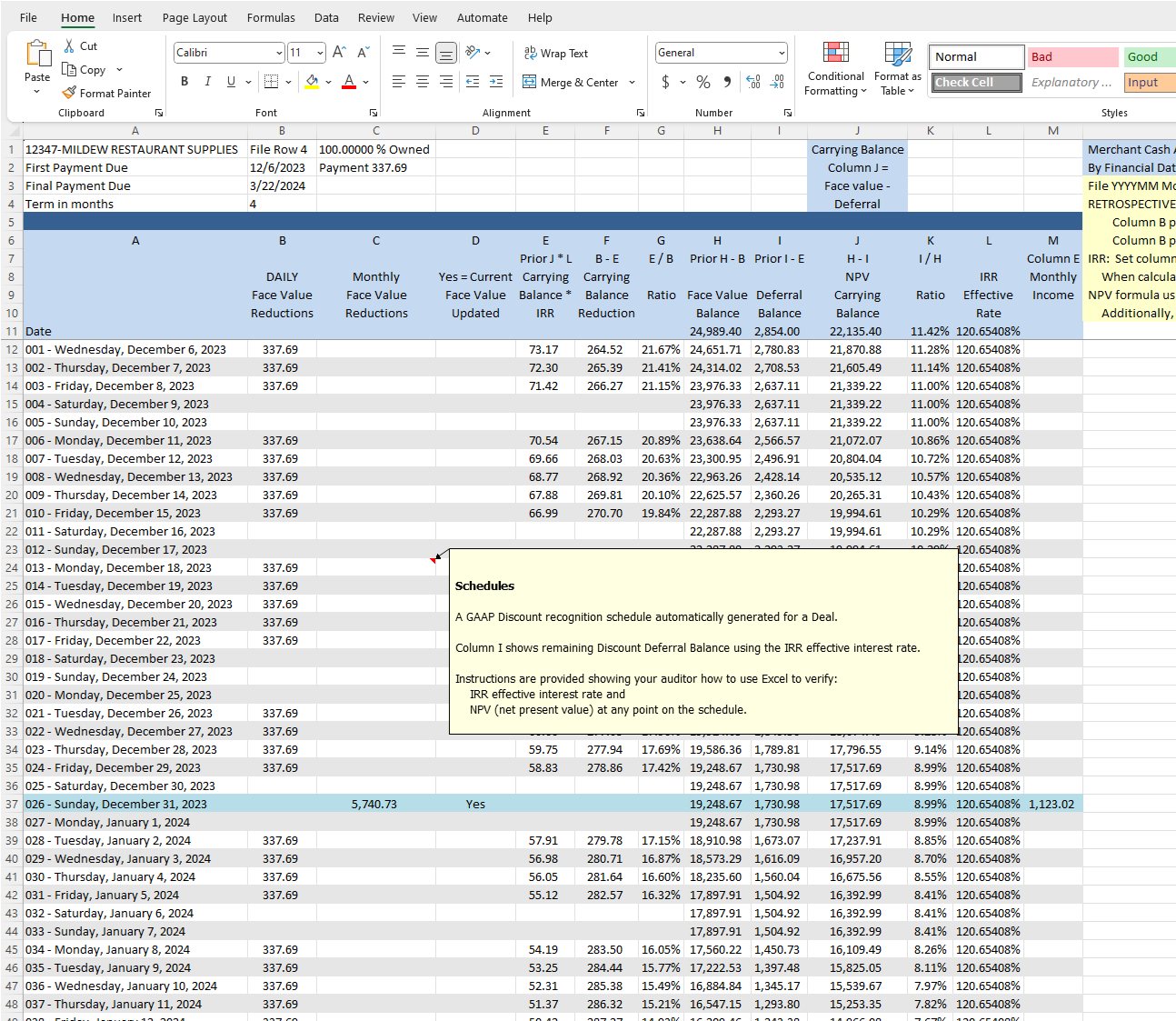

Lifetime amortization schedule

for each fee, for each record.

Deferral

% reductions for syndicated participations.

Clear up auditing exceptions with a minimum

amount of effort.

Determine what

Discount, other

Income

and Expense BALANCES should

be

when

using the GAAP

effective

interest method

for daily and

other frequency

payments

End of month

End of year

Compare software

deferral balance to

cash basis deferral balance.

Adjust income, expense accordingly.

Designed to

eliminate footnote exceptions on

Financial Statements

Audit schedules

for each deal:

Day-by-Day

recognition

schedule opens in Excel

Monthly totals

Supportive documentation

IRR, NPV independent

verification in seconds

Show results

for any deal(s) to your auditor

|

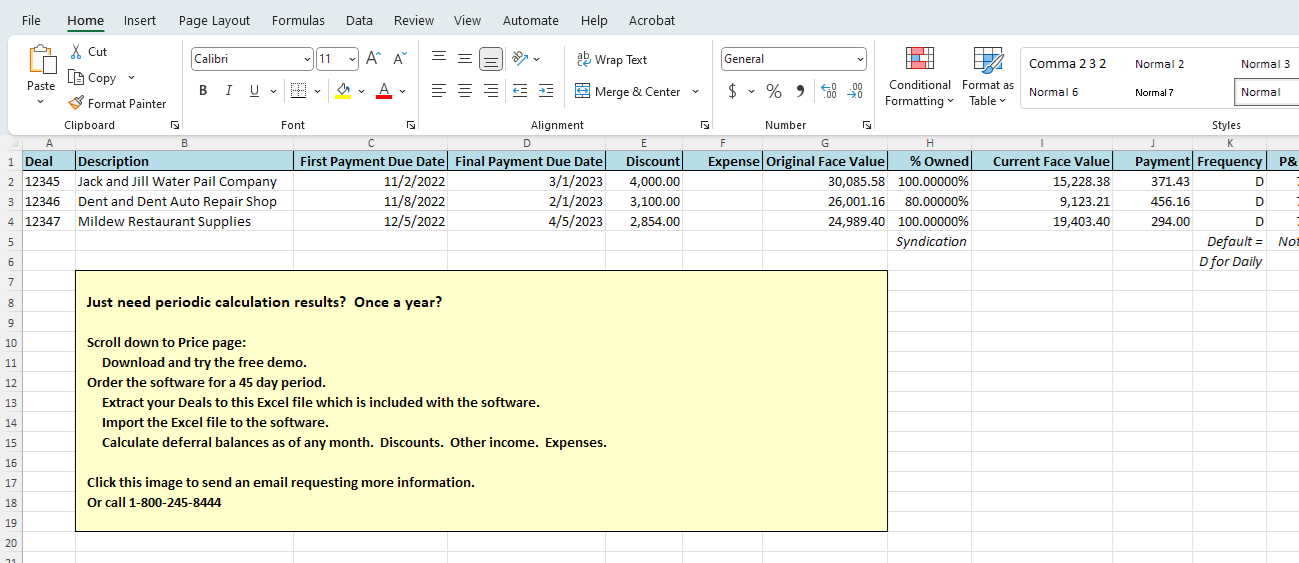

Easy to operate

Automatically import MCA Deals file to the

software

Import basic information for each Deal

consisting of:

Deal number/Description

First pay date

Final pay/maturity date

Original Face Value

Discount, Profit (or other fee to be amortized as income,

expense)

Deferral % Owned if syndicated

Current Face Value

Payment frequency: Daily

and other frequencies

Payment amount:

Prior periods,

software

determines an

average payment

based on

((Original Face

Value - Current

Face Value) /

Payments Due)

Future periods,

software

utilizes Payment

amount and can,

if necessary,

extend Final

Payment Due Date

Daily payments exclude the following

dates:

Saturday

Sunday

And the observed day for

New Year's

Martin Luther King birthday

Memorial day

July 4th

Labor day

Veteran's day

Thanksgiving

December 25th

Exception: If a Final Payment date falls on any

of the above, the Final Payment will become a Payment.

|

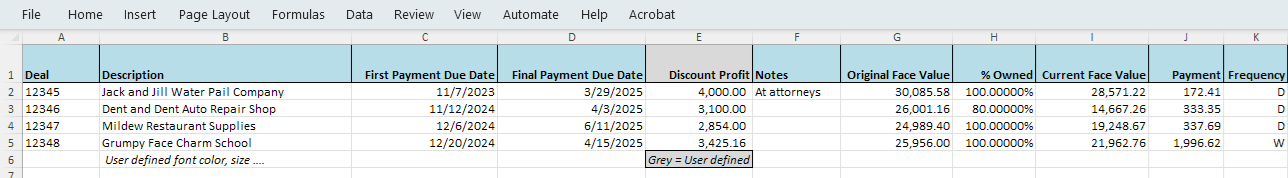

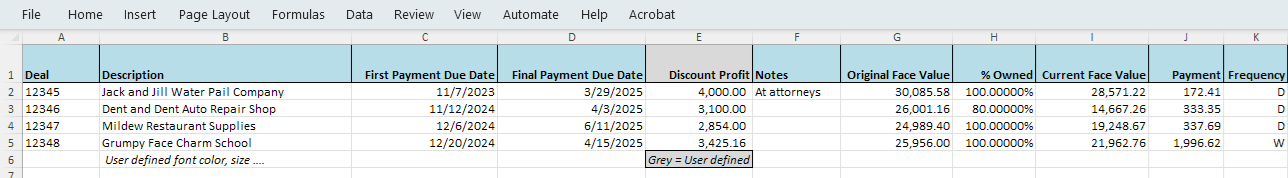

Import File

Layout and

Column

Documentation

Extract Deals

from a servicing

system.

Populate

this

Excel template

that comes with

the software.

Automatically

import Deals to

the software.

Grey Column

Headers can be

renamed to suit

your operation.

Column L through

X values are not

required.

Column A

Deal

Number (Value

required)

Typically a

numeric value by

which to

identify this

record when

viewed on

reports.

Column B

Description

(Value can be

blank)

An alphanumeric

value by which

to identify this

record when

viewed on

reports.

Typically

customer name.

Column C

First Payment

Due Date

(Value required)

The first day

Deferral

amortization is

to begin as

m/d/yyyy.

If

the date is in

the past, the

system will

amortize

forward.

If

this date is

later than the

file import

date, the Deal

will not show

any amortization

recognition.

Column D

Final Payment

Due Date

(Value required)

The final day of

Deferral

amortization as

m/d/yyyy year

(must be 4

digits).

The

Final Payment

Due Date may be

recalculated by

the software

based on Payment

and Current Face

Value at time of

import.

Column E

Discount

Profit

(Column Header

can be changed)

(Value can be

blank, 0.00 or a

positive number)

Contains profit

income (the

Deferral) amount

to be amortized.

Ex:

Proceeds

check =

20,000.00

Profit on deal =

10,000.00

Face Value =

30,000.00, the

total amount to

be paid by

customer.

Profit of 10,000

is a Discount

with respect to

Face Value and

is the Deferral

amount to be

amortized under

GAAP.

Additional

Income and

expense amounts

are supported

starting in

column Q.

Column F

Notes (Column

Header can be

changed) (Value

can be blank)

A value in this

column will be

appended to

Column B

Description.

Column G

Original Face

Value

(Positive Value

required)

Column D

Discount Profit

will be

subtracted from

the value in

this column to

determine Net

Present Value.

Column H

Percent Owned or

retained if

Syndicated

If blank, 0 or

100, the system

will recognize

the full

Deferral amount,

such as

Discount.

If

a %, the system

will recognize

that percentage

of the Deferral,

i.e. the

Deferral will be

reduced.

Ex:

If Discount =

$10,000 and

Percent Owned =

40%, the

Deferral amount

to be recognized

would be $4,000.

Column I

Current Face

Value

(Positive Value

required)

The current face

value. Total

amount still due

or 0.00.

If

value is less

than 0.00, the

system changes

the value to

0.00.

Column J

Payment

(Positive Value

required)

The software

determines an

"average" cash

flow payment

using valid due

dates (excludes

weekends, etc.)

based on the

difference

between Original

Face Value and

Current Face

Value as of the

file import

month.

Subsequent month

payments are the

imported Payment

in this column.

Column K

Payment

Frequency

(Value

required) If

blank, value

becomes D for

Daily

D or Daily

(default value

if blank)

W

or Weekly

B

for Bi-weekly

(software treats

as weekly using

1/2 of payment)

M for Monthly

(software treats

as weekly by

multiplying

payment X

12/52).

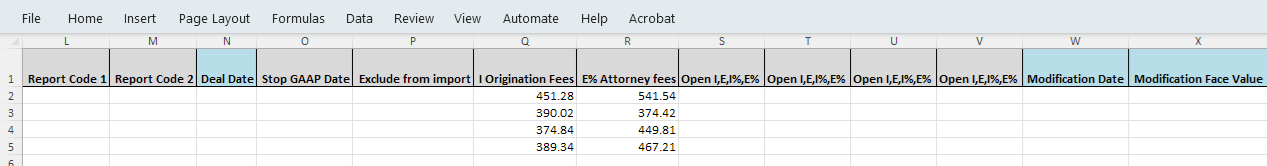

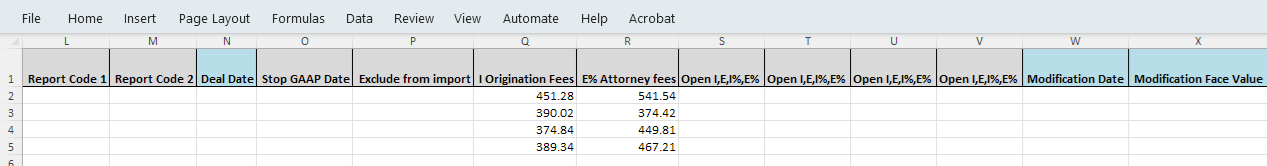

Column L

Report Code 1

(Column Header

can be changed)

(Value can be

blank)

The system can

generate reports

with subtotals

for records

sorted by one or

both user

defined values

in Columns L and

M.

Examples

of user defined

values:

Deal type, such

as restaurant,

auto repair,

retail and so

forth.

Deal

originator:

Employee who

closed the Deal.

Deal

location: City,

borough, common

geographical

sections.

Other codes

or descriptions

for which totals

are desired.

Column M

Report Code 2

(Column Header

can be changed)

(Value can be

blank)

The system can

generate reports

with subtotals

for records

sorted by one or

both user

defined values

in Columns L and

M.

Column N

Deal

Date (Column

Value not

required) (If

blank, Value

becomes First

Payment Due

Date)

The date the

Deal closed,

typically the

day a Deal was

funded.

If

blank, the

software will

insert the First

Payment Due

Date.

Column O

Stop

GAAP Date

(Column Header

can be changed)

(Value can be

blank)

Normally blank.

If a date exists

in this column,

the software

will stop

amortizing the

Deferral as of

this date.

The software

will retain the

Deferral balance

as of this date.

Might be used to

indicate a deal

was or is about

to be written

off.

Column P

Exclude from

Import (Column

Header can be

changed) (Value

can be blank)

Normally blank.

Otherwise, ANY

value, whether a

date, text,

number or

anything other

than a blank

value will

exclude the Deal

from being

imported.

Typically used

to exclude Deals

that are

basically "dead"

or have major

problems.

Columns Q thru V

Additional Fees

(Column

Headers can be

changed) (Values

can be blank,

0.00 or a

positive number)

Up to 6 user

defined columns

to amortize

additional fees

using GAAP.

Column Names:

1st character

must be: (not

case sensitive)

I for

Income or

E for expense

2nd character is

optional:

% means the

fee is subject

to %Owned

column, the

syndicated

percentage.

If %Owned =

40%, then the

fee will be

reduced. 100.00

fee with %Owned

of 40.00000 will

amortize a

Deferred fee of

40.00

Accepted entries

I = Income

E = Expense

I% =

Income, adjusted

by % Owned

E% =

Expense,

adjusted by %

Owned

Ex:

Column header =

E% Attorney Fees

Attorney Fee for

a Deal = 500,00

Percent Owned =

40.00%

Amount

of fee will be

recognized as

Expense of

200.00 which is

(500.00 * 40%)

Column W

Modification

Date (Value

can be blank)

(if used,

requires a value

in X)

A Modification

Date notifies

the system when

you change a

Payment Amount

and/or Final

Payment Due

date.

Original Face

Value =

100,000.00

Original

Discount Profit

= 10,000

First Payment

Due date =

1/1/2024

Final Payment

Due date =

12/31/2024

Modification

Date = 6/15/2024

Face Value as of

Modification

Date = 40,000

(Column X)

When a

Modification

occurs, the

software treats

the earlier part

of the Deal as

being complete

and recognizes

that portion of

a Discount and

other fees using

a cash basis

method, i.e.,

payments

received in

cash.

Using

Original Face

Value and

Current Face

Value, the

software

calculates:

Cash basis

uses the

percentage of

Original

Discount /

Original Face

Value:

(10,000 / 100,000),

which is 10%.

For every dollar

received, 10% of

that dollar

reduces Discount

Deferral, 90%

reduces

Proceeds.

As of

the Modification

Date,

Cash basis

discount

recognition is

Face Value

Reduction

(100,000 -

40,000) of

60,000. (60,000

* above percent

of 10%) =

6,000.00.

Remaining

discount = 4,000

(10,000 - 6,000)

An amortization

schedule will

show "two

deals".

First

deal will

amortize the

discount in full

using Face Value

of amount

received, 60,000

and a

Discount of

6,000.00.

Second deal will

begin amortizing

the remaining

values using

GAAP.

Remaining Face

Value of

40,000.

Remaining Discount

of

4,000.00.

Payment Amount

can be changed.

Final Payment

Due date can be

changed.

First Payment

Due date must

remain as

1/1/2024.

Except for

Payment Amount

and Final

Payment Due

date, all other

values need to

remain the same

as the original

deal.

Column X

Modification

Face Value

(Column Header

can be changed)

(Value can be

blank, 0 or a

positive value)

(if used,

requires a value

in W)

Normally blank.

If Column W has

a date, Column X

must be the Face

Value of the

deal as of the

Modification

Date in Column

W.

Also see

Column W, above.

|

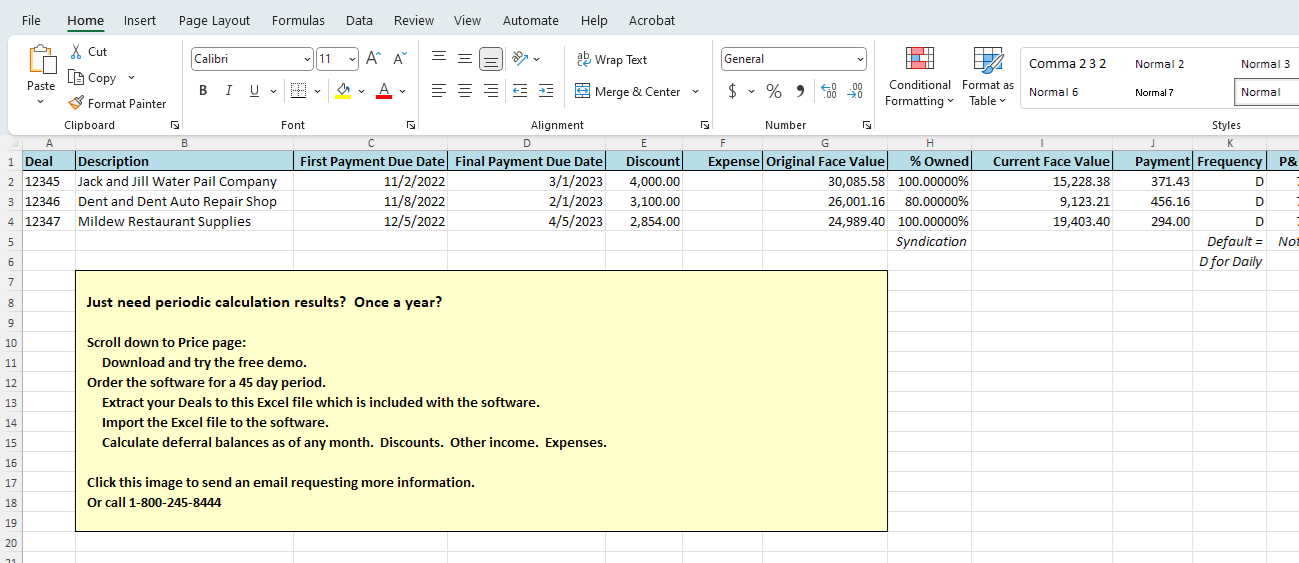

Price

Click to open and view MCA

Price page

Includes

free demo link with:

• A live version of the software

• Sample records

• Ability to run detail schedules

Annual license or

45 day license for

only $745.00

For more information,

please call

1-800-245-8444

(Florida, Eastern Time)

or

email

Support@fdssi.com

|

|

|

|